ICE Mortgage Monitor: Record Levels of Home Equity, Falling Rates Drive Highest HELOC Withdraws Since 2008

U.S. mortgage holders carried a record $17.6 trillion in home equity entering the second quarter–with $11.5 trillion considered “tappable”–according to ICE Mortgage Technology, Atlanta.

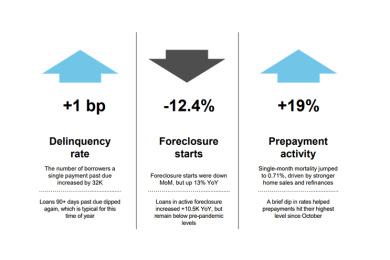

Cotality: Mortgage Delinquencies Steady in March

Cotality, Irvine, Calif., released its Loan Performance Indicators, finding that delinquencies were flat in March on an annual basis.

Advocacy Victory: Maryland OFR Rescinds Mortgage Trust Licensing Policies Following Enactment of MBA-Supported Legislation

Recently the Maryland Office of Financial Regulation (OFR) announced that it rescinded its previous guidance that required the licensing of passive mortgage trusts following advocacy from the Mortgage Bankers Association (MBA) and the Maryland Mortgage Bankers and Brokers Association (MMBBA).

Jobs Increase by 139,000 in May; Unemployment Remains Flat

Total nonfarm payroll employment increased by 139,000 in May, with the unemployment rate flat at 4.2%, the U.S. Bureau of Labor Statistics reported.

Neptune Flood: Texas at Risk of Flood Insurance Shortfall

Neptune Flood, St. Petersburg, Fla., released an analysis of flood risk for Texas, finding that only 7% of residential properties statewide have flood insurance, despite considerable chance of flooding.

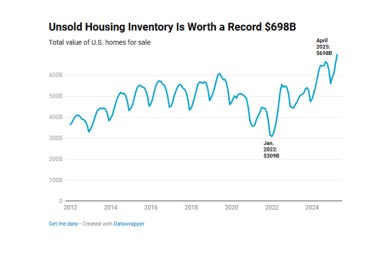

Redfin: Value of Homes on the Market Hits Record

Redfin, Seattle, released a new report finding that there are $698 billion in homes currently on the market–the highest dollar amount ever recorded.