ICE: Mortgage Refinance Retention Reaches Multi-Year High

(Cover illustration courtesy of Johnson via Unsplash)

Mortgage servicer refinance retention rose to a 3.5-year high in the third quarter as falling interest rates encouraged homeowners to reduce monthly payments for lower returns than in past cycles.

“Modest rate relief this fall has driven mortgage application volumes to multi-year highs, showing the outsized impact that incremental affordability improvements have on borrower behavior and servicer retention opportunities,” ICE Head of Mortgage and Housing Market Research Andy Walden said in the December ICE Mortgage Monitor Report. “We’re now seeing the highest concentration of rate-and-term refinances in nearly five years, almost entirely driven by borrowers holding 2023-2025 vintage loans.”

Walden noted the market has become more rate sensitive as hundreds of thousands of borrowers move in and out of refinance incentive with small daily rate shifts. “This behavior shows how quickly demand can return when affordability improves, and it highlights just how closely households are watching rates as they try to manage monthly costs and access equity,” he said.

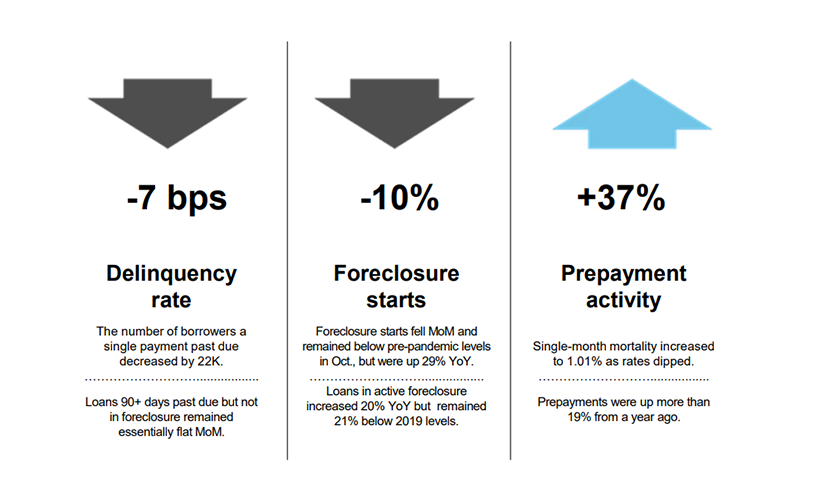

Illustration courtesy of ICE

Key findings from the December Mortgage Monitor include:

• Refinance retention hit a 3.5-year high, led by non-bank servicers

Refinance retention reached a 3.5-year high (28%) in Q3 2025, with servicers retaining more than half of borrowers refinancing out of 2024 vintage loans. Rate-and-term retention rose to 37%, one of the highest points in the past decade, while cash-out refinance retention rose to a more modest 23%, reflecting the challenge of identifying and retaining equity-seeking borrowers.

Non-banks retained refinancing borrowers at roughly three times the rate of banks (35% versus 13%). Retention was highest among FHA and VA mortgages (36%), trailed by GSE (25%) and portfolio-held loans (23%) and privately securitized loans (6%).

• Rate-and-term refinances dominated activity as more borrowers move back “in the money”

Rate-and-term refinances accounted for 62% of all refinance activity in October, the highest share in nearly five years. An estimated 95% of rate-and-term refinances in September and October involved 2023–2025-era loans, with the average refinancer carrying a loan balance of $505,000 and a credit score around 762. On average, they reduced their mortgage rate by 0.92 percentage points, translating to an average monthly savings of about $200.

• Second-lien home equity withdrawals surged to 18-year high

Second-lien home equity loan withdrawals climbed to their strongest level since 2007 in Q3 2025 as falling short-term rates made tapping equity more affordable. With millions of homeowners still locked into historically low first-lien rates, many are opting to access equity through home equity loans or HELOCs rather than refinancing their first mortgage.

• Home affordability is at its best levels in nearly three years, but remains stretched

In mid-November, mortgage rates averaged 6.25%, bringing the monthly principal and interest payment for a median-priced home to $2,126. That payment equals 29.7% of the median household income, the lowest since early 2023.