Share of Mortgage Loans in Forbearance Increases to 0.34% in September

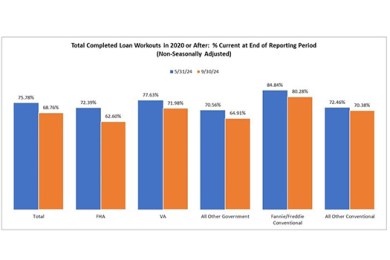

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance increased to 0.34% as of Sept. 30, 2024.

FundingShield: Fraud Risk Report Shows Slight Drop

FundingShield, Newport Beach, Calif., found that during the third quarter, 46.43% of transactions on an $82 billion portfolio of residential, commercial and business purpose loans had issues leading to a risk of wire and title fraud.

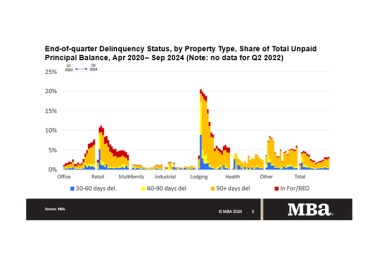

Commercial, Multifamily Mortgage Delinquency Rates Increase in Third Quarter

Delinquency rates for mortgages backed by commercial properties increased slightly during the third quarter of 2024.

ValuePenguin: Winter Weather Property Damage Already at $61.8M in 2024

As we head into the winter months in much of the United States, ValuePenguin, a division of LendingTree, Charlotte, N.C., put out a report on winter weather damage. So far, winter weather has caused an estimated $61.8 million in property damage in 2024.

MBA Chart of the Week: New Home Purchase Applications by Loan Type

Mortgage applications to buy newly built homes have been seeing year-over-year growth since 2023, and in the MBA Builder Applications Survey results for September 2024, purchase applications were up 11% on an annual basis.

DPR: 29 Homebuyer Assistance Programs Added in Q3

Down Payment Resource, Atlanta, released its Q3 Homeownership Program Index Report, highlighting the homebuyer assistance programs added and available in the quarter. The number offered reached 2,444 in Q3.