MBA: Mortgage Delinquencies Decrease Slightly in the Third Quarter of 2024, Up on Annual Basis

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased slightly to a seasonally adjusted rate of 3.92% of all loans outstanding at the end of the third quarter of 2024 compared to one year ago, according to the Mortgage Bankers Association’s National Delinquency Survey.

MBA RIHA Report: Housing Supply Will Remain Tight as Older Americans Continue to ‘Age in Place’

As older Americans continue to remain living in their homes for longer, and the homeownership rate for Americans over 50 continues to increase, there will be excess demand for older Americans’ homes over the next decade as shifting demographics impact housing for homebuyers of all ages.

ICE: Record Levels of Tappable Equity in Q3

Intercontinental Exchange Inc., Atlanta, reported that mortgage holders at the end of the third quarter held $17.2 trillion in equity. Of that, $11.2 trillion was deemed tappable–meaning it can be borrowed against with the homeowner still maintaining a 20% equity stake.

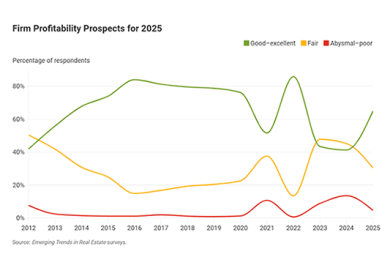

PwC, ULI: Real Estate Confidence Increasing

Real estate industry leaders are more confident now than a year ago, but they remain cautious, according to Emerging Trends in Real Estate 2025, published by PwC and the Urban Land Institute.

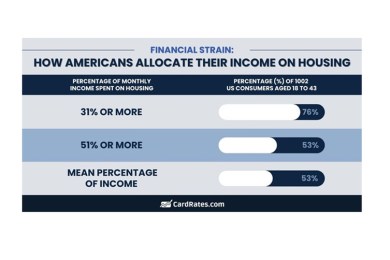

CardRates: Many Young Americans Spending Significantly on Housing

CardRates, Gainesville, Fla., released a survey of millennial and Gen Z Americans, finding 76.32% of respondents are spending more than 31% of their monthly income on housing.