MBA Applauds Efforts to Improve Loan Repurchase Requests; Calls for Better Alignment at the GSEs

MBA President and CEO Bob Broeksmit, CMB, issued a statement regarding recent moves by Fannie Mae and Freddie Mac to address loan repurchase requests.

CoreLogic: Delinquencies Nearly Flat in December

CoreLogic, Irvine, Calif., reported the national overall mortgage delinquency rate was 3.1% in December, up by 0.1 percentage point year-over-year from December 2022 and 0.2 percentage point from November.

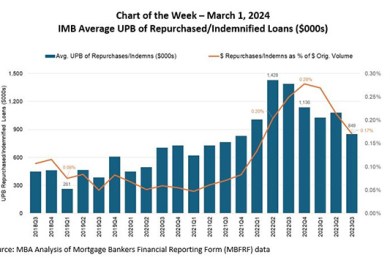

MBA Chart of the Week: IMB Average UPB of Repurchased/Indemnified Loans

MBA Research recently analyzed repurchase and indemnification volume over a five-year period from the third quarter of 2018 through the third quarter of 2023.

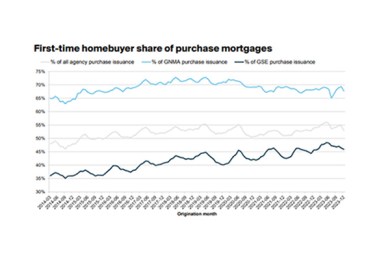

ICE Mortgage Monitor: 2023 Saw Three-Decade Low in Originations

Intercontinental Exchange Inc., Atlanta, released its Mortgage Monitor report for March, featuring some full-year 2023 insights. Among those, the report recorded only 4.3 million mortgages as originated in 2023, the lowest since ICE began tracking the data 30 years ago.

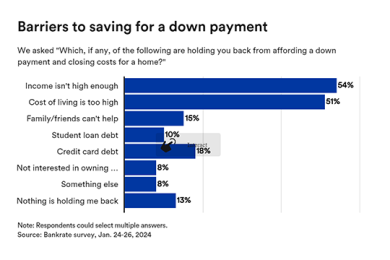

Many Aspiring Homeowners Cite Cost of Living, Insufficient Income as Roadblocks: Bankrate

More than half of aspiring homeowners say the current cost of living is too high or their income is not high enough to afford a down payment and closing costs for a home (51% and 54% respectively), reported Bankrate, New York.