CoreLogic: Homeowner Equity Increases to Near All-Time High in Q1

CoreLogic, Irvine, Calif., released its Homeowner Equity Insights Report for the first quarter, finding that U.S. homeowners with mortgages saw home equity increase by 9.6% year-over-year.

Jobs Report: 272,000 Added in May

The U.S. Bureau of Labor Statistics announced nonfarm payroll increased by 272,000 and the unemployment rate was at 4% in May.

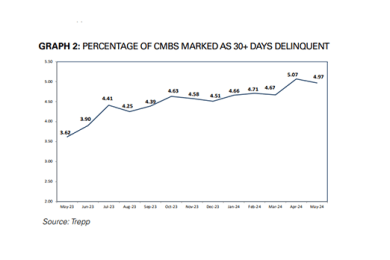

Trepp Reports CMBS Delinquency Rate Dips

Trepp, New York, reported the commercial mortgage-backed securities delinquency rate dipped back below 5% in May.

Fitch: Solid Demand, Home Price Growth Will Continue to Boost U.S. Housing Economy

The U.S. residential housing economy, which represents about 17% of GDP, will likely continue growing in second-half 2024 despite unaffordability due to high home prices and mortgage rates, according to Fitch Ratings, Chicago/New York.

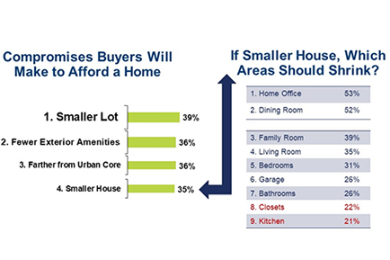

Buyers Willing to Give Up Land in Exchange for Homeownership

High mortgage rates and double-digit growth in home prices since COVID-19 are forcing home buyers to compromise on lot size and square footage to afford a house, the National Association of Home Builders reported.