MBA, ABA Respond to CFPB’s Mortgage Servicing Proposal

The American Bankers Association and Mortgage Bankers Association issued a joint statement in response to the Consumer Financial Protection Bureau’s proposed rule, Streamlining Mortgage Servicing for Borrowers Experiencing Payment Difficulties; Regulation X.

MBA Opposes Biden Campaign’s Nationwide Rent Control Proposal

MBA’s President and CEO Bob Broeksmit, CMB, released a statement on President Joe Biden’s campaign proposal to cap rents nationally.

ATTOM Finds Foreclosure Activity Down From a Year Ago

ATTOM, Irvine, Calif., found 177,431 U.S. properties with foreclosure filings in the first six months of 2024, down 4.4% from first-half 2023 but up 7.8% from the same period two years ago.

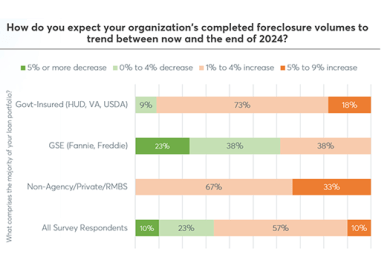

Auction.com Finds Most Default Servicers Expect Soft Landing, Slowly Rising Foreclosures

Most default servicers expect a soft landing in the economy and a gradual increase in foreclosure volumes in the second half of 2024, according to Auction.com, Irvine, Calif.

MBA-Recommended 203(k) Program Changes Adopted by HUD

HUD released an updated set of policies for its 203(k) Rehabilitation Mortgage Insurance Program, including a number of recommendations the Mortgage Bankers Association had suggested in a Jan. 3 letter.

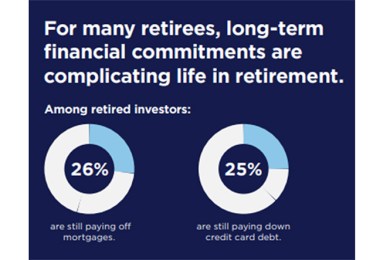

Nationwide: A Quarter of Retired Investors Still Paying Off Mortgages

Nationwide, Columbus, Ohio, released its annual Advisor Authority study, powered by the Nationwide Retirement Institute, finding that 26% of retired investors are still paying mortgages and 25% are paying off credit card debt.

Clever Real Estate: 98% of Gen Z Sees Significant Barriers to Home Ownership

Clever Real Estate, St. Louis, released a new survey delving into Gen Z’s attitudes and expectations for home ownership, finding that 60% of the generation worries they will never own a home.