Broeksmit Discusses Recent Wins, Current Challenges: #MBAIMB24

NEW ORLEANS–In the face of a difficult business climate, the Mortgage Bankers Association is fighting for Independent Mortgage Bankers every day to ensure they can deliver for borrowers, MBA President and CEO Robert Broeksmit, CMB, said here at MBA’s Independent Mortgage Bankers conference.

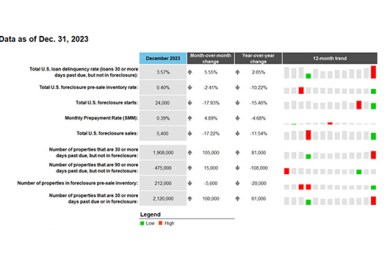

ICE ‘First Look’ for December: Foreclosure Starts at 18-Month Low

Intercontinental Exchange Inc., Atlanta, released its “first look” at mortgage performance data for December, noting that at 24,000, foreclosure starts marked an 18-month low in new activity. Total active foreclosures are the lowest since March 2022, and 25% below pre-pandemic levels.

Freddie Mac’s Kevin Kauffman on DPA, Repurchases: #MBAIMB24

NEW ORLEANS–It’s important to solve problems together as an industry, Freddie Mac Vice President of Single-Family Client Engagement Kevin Kauffman said here at MBA’s Independent Mortgage Bankers Conference.

Fannie Mae’s Tim McCallum Discusses 2024 Expectations: #MBAIMB24

NEW ORLEANS–Tim McCallum, senior vice president and head of single-family business account management at Fannie Mae, sees more optimism in the market today than in recent months.

Total Expert’s Joe Welu: Retention Is the Key to Winning the 2024 Refi Surge

We knew it was coming—eventually. After 11 rate hikes starting in March 2022, the Fed in December 2023 signaled its intentions to lower rates through 2024. With mortgage rates already dropping, virtually everyone that bought a home in the last 18 months will benefit from a refinancing conversation with their lender.

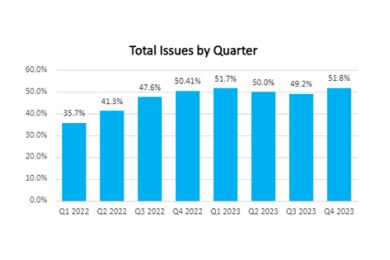

FundingShield: Q4 2023 Analytics Show Significant Risk for Wire, Title Fraud

FundingShield, Newport Beach, Calif., reported wire and title fraud risk reached a high of 51.8% of loans on a $61 billion portfolio having at least one risk issue in the fourth quarter.

Fitch Says Weaker Collateral for Non-QM/Non-Prime 2023 RMBS Leads to Elevated Delinquency Rate

Fitch Ratings, New York, said delinquencies for non-QM 2023-vintage RMBS transactions are higher than the 2022 vintage, reflection weaker collateral attributes.