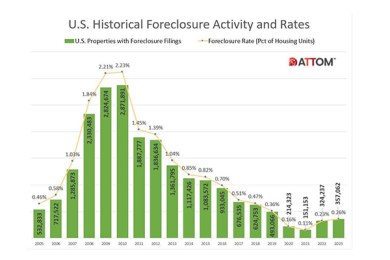

ATTOM: 2023 Foreclosure Filings Top 2022, but Remain Below Pre-Pandemic Numbers

ATTOM, Irvine, Calif., released data on year-end 2023 foreclosures, finding that foreclosure filings were up 10% from 2022 and 136% from 2021. However, they were down 28% from pre-pandemic 2019.

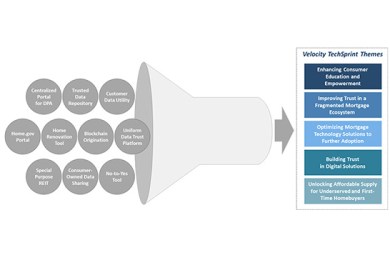

FHFA TechSprint Spotlights Themes Related to Mortgage Technology

The Federal Housing Finance Agency last summer held its “Velocity” TechSprint, bringing people together to ponder how data digitization could drive transparency and increase access, fairness, affordability and sustainability in mortgage lending. FHFA briefed MISMO Winter Summit attendees about the program Monday.

LERETA’s John Walsh: Higher Taxes and Insurance Will Surprise Borrowers with Escrow Accounts in 2024. Are Servicers Ready?

While homeowners across the U.S. are celebrating the record-high appreciation in their home values and, as a result, their home equity, servicers are preparing for the other shoe to drop: an accompanying rise in real estate taxes, affecting escrow balances and creating issues for both borrowers and servicers.

Inflation Increases Slightly in December

The headline inflation rate increased modestly during December, the Bureau of Labor Statistics reported Thursday.

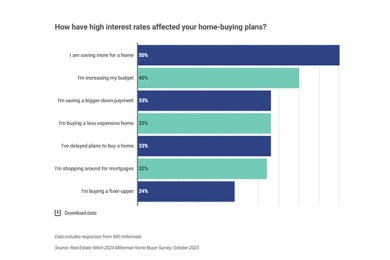

95% of Millennials Report Facing Barriers to Homeownership, Survey Finds

While 78% of millennials say purchasing a home is part of the American dream, 48% don’t think homeownership is affordable for the average member of their generational cohort.