ATTOM: 2023 Foreclosure Filings Top 2022, but Remain Below Pre-Pandemic Numbers

(Image courtesy of ATTOM)

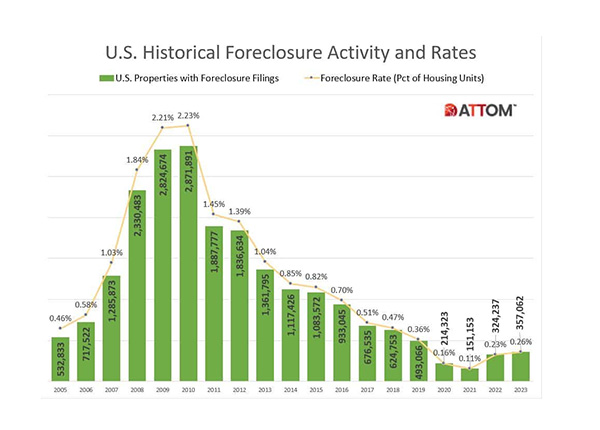

ATTOM, Irvine, Calif., released data on year-end 2023 foreclosures, finding that foreclosure filings were up 10% from 2022 and 136% from 2021. However, they were down 28% from pre-pandemic 2019.

Additionally, 2023’s numbers were 88% below the peak reached in 2010.

There were foreclosure filings–defined as default notices, scheduled auctions and bank repossessions–on 357,062 properties.

“Reflecting on 2023, we see the recent rise in foreclosure activity as a market correction rather than a cause for alarm. It signals a return to more traditional patterns after years of volatility,” said Rob Barber, CEO at ATTOM. “Our data suggests that while foreclosure activity may fluctuate, it’s unlikely to approach the highs seen in the last decade. Instead, we foresee a market that is more reflective of broader economic trends, with foreclosure filings becoming a more predictable aspect of the housing landscape. This shift offers a silver lining–the opportunity for investors, homeowners, and industry professionals to plan and strategize with greater confidence and insight.”

There were 270,222 properties that had foreclosure starts last year, up 9% from 2022 and 193% from 2021, but down 20% from 2019.

However, bank repossessions also declined slightly from 2022. Lenders repossessed just 42,090 properties via foreclosure.

That’s down 2% from 2022 and 71% below 2019.

For the fourth quarter specifically, there were 92,896 properties with foreclosure filings, down 8% from Q3, but up 2% year-over-year.

And for December, 20,490 properties started the foreclosure process. That’s down 8% from November, and a 3% decrease from the previous December.