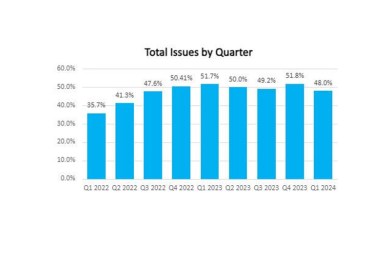

FundingShield: Q1 Wire, Title Fraud Risk Remains High

FundingShield, Newport Beach, Calif., reported that wire and title fraud risk dropped somewhat from record-breaking levels hit in the fourth quarter of 2023, but 48% of loans processed in the quarter still exhibit at least one risk factor.

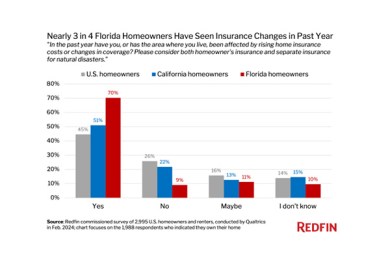

Redfin: Florida, California Homeowners See More Insurance Changes

Redfin, Seattle, recently reported 70.3% of Florida homeowners and 51% of California homeowners say they or the area they live in have been affected by rising home insurance costs or changes to coverage over the past year.

FHFA Requests Public Input on Freddie Mac Second Mortgage Proposal

The Federal Housing Finance Agency on Tuesday proposed a new product from Freddie Mac to begin purchasing certain single-family closed-end second mortgages.

Tavant’s Hassan Rashid on Unlocking Home Equity: A Strategic Move for 2024

As we make strides into 2024, American homeowners find themselves amidst an intriguing landscape of financial opportunities, particularly concerning the utilization of home equity.