A Tale of Two Reports on Household Debt

Two reports offer slightly different takes on the state of household debt in the first quarter.

WalletHub, Miami, reported this week that total household debt fell to $17.12 trillion in the first quarter as consumers paid down nearly $140 billion in debt during that period. Separately, the Federal Reserve of New York took a slightly different tack, reporting an increase in total household debt in the first quarter by $148 billion (0.9%) to $17.05 trillion.

The difference probably comes down to how each report collected and interpreted disparate data.

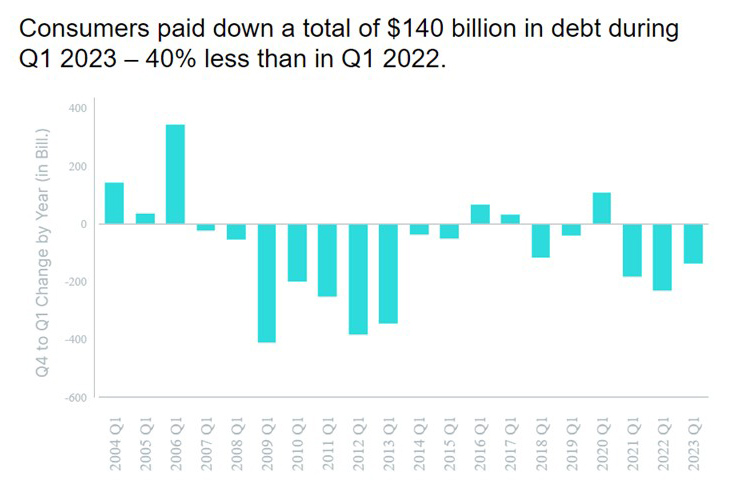

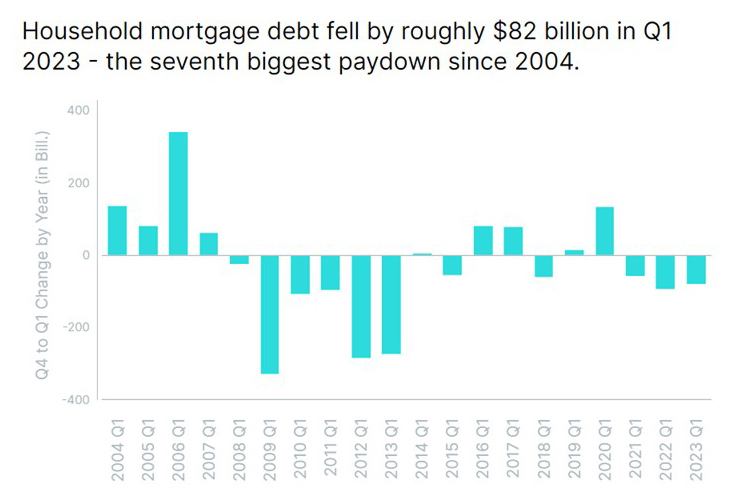

Let’s start with WalletHub. The company’s quarterly Household Debt Report said consumers paid down $140 billion in debt during Q1 2023 – 40% less than a year ago, while reporting total household debt fell to $17.13 trillion. Household mortgage debt decreased by $82 billion in the first quarter, the seventh biggest paydown since 2004. Debt from home equity lines of credit fell by $2.7 billion, the 14th consecutive first quarter paydown.

The report noted although current debt is not at a record high, the average household owed a total of $143,626 at the end of the first quarter was only $12,918 below WalletHub’s projected breaking point for household finances.

“First-quarter debt reduction is common, as New Year’s resolutions are fresh in mind, budgets are newly made, and the combination of tax refunds and salary bonuses makes us feel flush,” said Jill Gonzalez, WalletHub analyst. “Unfortunately, we don’t expect continued paydowns in the following quarters, as the first quarter reduction will get wiped out and then some in the months to come.”

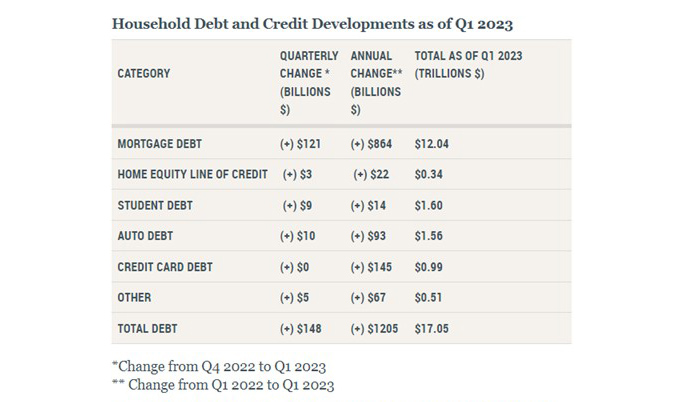

Meanwhile, the Federal Reserve Bank of New York’s Center for Microeconomic Data Quarterly Report on Household Debt and Credit showed an increase in total household debt in the first quarter, increasing by $148 billion (0.9%) to $17.05 trillion. Balances now stand $2.9 trillion higher than at the end of 2019, before the pandemic recession.

The report said mortgage balances rose modestly by $121 billion in the first quarter and stood at $12.04 trillion at the end of March. Credit card balances were flat in the first quarter, at $986 billion. Auto loan balances increased by $10 billion in the first quarter, bucking the typical trend of balance declines in first quarters. Student loan balances slightly increased and now stand at $1.60 trillion. Other balances, which include retail cards and other consumer loans, increased by $5 billion. In total, non-housing balances grew by $24 billion.

Mortgage originations, which include refinances, dropped sharply in the first quarter of 2023 to $324 billion, the lowest level seen since 2014. The volume of newly originated auto loans was $162 billion, a reduction from pandemic-era highs but still elevated compared to pre-Covid volumes. Aggregate limits on credit card accounts increased by $119 billion, representing a 2.7% increase from Q4 2022 levels. Limits on home equity lines of credit were up by $9 billion in the first quarter.

The share of current debt becoming delinquent increased for most debt types. The delinquency transition rate for credit cards and auto loans increased by 0.6 and 0.2 percentage points, respectively approaching or surpassing their pre-pandemic levels.

“The mortgage refinancing boom is over, but its impact will be seen for decades to come,” said Andrew Haughwout, Director of Household and Public Policy Research at the New York Fed. “As a result of significant equity drawdowns, mortgage borrowers reduced their annual payments by tens of billions of dollars, providing additional funding for spending or paydowns in other debt categories.”

The report found $324 billion in newly originated mortgage debt in the first quarter. With the pandemic-era refinance boom over and a slowdown in home sales, both refinance and purchase mortgage originations declined substantially in the first quarter.