#MBASecondary23: Broeksmit: ‘You Don’t Need Punishment or More Regulation; You Need Praise and Relief—and You Need it Now’

NEW YORK—When Mortgage Bankers Association President & CEO Bob Broeksmit, CMB, stepped on stage Monday here at the National Secondary Market Conference & Expo, he promised a presentation “more pugnacious than normal.” And he delivered.

#MBASecondary23: The Future of Financial Stability

NEW YORK—What issues are affecting the financial markets? How many fingers do you have?

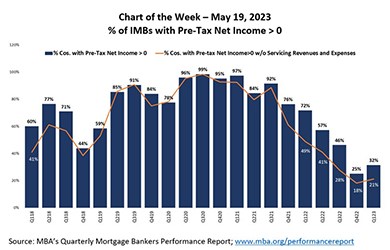

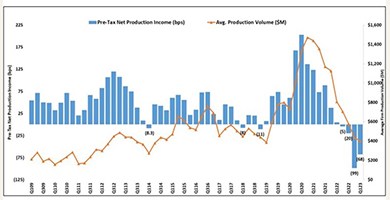

MBA: IMBs Report Pre-Tax Net Production Losses in 1Q

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net loss of $1,972 on each loan they originated in the first quarter, an improvement from the reported loss of $2,812 per loan in the fourth quarter, the Mortgage Bankers Association reported Thursday.

Senators Introduce MBA-supported Bill to Reform Davis-Bacon Rules

Sens. John Thune, R-S.D., and Jerry Moran, R-Kan., on Friday reintroduced the Housing Supply Expansion Act, legislation that would address the affordable housing shortage by making targeted reforms to Davis-Bacon Act requirements.

Seth Sprague, CMB, of Richey Mae: Now’s the Time to Prepare for FHFA/Ginnie Mae Rules Changes for Non-Bank Servicers

On August 17, 2022, the Federal Housing Finance Agency and Ginnie Mae jointly announced updated minimum financial eligibility and capital rules for seller/servicers and issuers. These changes update the capital and financial eligibility requirements for non-bank servicers that have been modified over the past year.

In Amici Brief to SCOTUS, MBA, Trade Groups Stress Importance of Mortgage Market Stability

While the brief takes no position on whether the Bureau is constitutionally funded, it urges the Court to avoid ruling in a manner that would disrupt the housing and mortgage markets, harming both consumers and the economy.

FHA Finalizes HECM Claims Processing Policies

The Federal Housing Administration on Wednesday announced new policies that will allow for faster payment of funds to mortgagees when they assign a Home Equity Conversion Mortgage (HECM), also known as a reverse mortgage, to HUD.