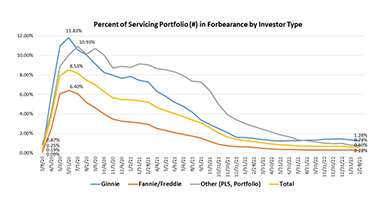

MBA: February Share of Mortgage Loans in Forbearance Decreases to 0.60%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 4 basis points tp 0.60% of servicers’ portfolio volume as of February 28 from 0.64% in January. MBA estimates 300,000 homeowners are in forbearance plans.

MBA: 4Q Commercial, Multifamily Mortgage Debt Outstanding Up By $324B

Commercial/multifamily mortgage debt outstanding at year-end 2022 rose by $324 billion (7.7 percent) from the previous year, the Mortgage Bankers Association’s latest quarterly Commercial/Multifamily Mortgage Debt Outstanding Report said.

MBA Launches CONVERGENCE Philadelphia

The Mortgage Bankers Association on Wednesday launched CONVERGENCE Philadelphia, its third city-based pilot program to promote and increase minority homeownership. CONVERGENCE Philadelphia joins initiatives underway in Memphis, Tenn., and Columbus, Ohio.

FHFA Delays Effective Date of GSE DTI Ratio-Based Fee to Aug. 1

The Federal Housing Finance Agency on Wednesday said it would delay implementation of certain recalibrated upfront fees for Fannie Mae/Freddie Mac until Aug. 1.

U.S. Loses 58 ‘Million-Dollar Cities’ Since July

Zillow, Seattle, said 464 cities in the U.S. have typical home values of $1 million or more. That’s way down from last July, when 522 cities hit the mark.