(IMB23) The Mortgage Market: IMB Leaders’ Perspectives

CORONADO, Calif.—With a volatile economic outlook, how are the practitioners—the independent mortgage bankers—approaching 2023 and beyond?

FHA Expands Assistance Options for Struggling Borrowers

The Federal Housing Administration on Monday announced expansion of its loss mitigation options used to help borrowers struggling to make mortgage payments on their FHA-insured mortgages.

ATTOM: Home Seller Profits Top 50% in 2022 Despite Market Slowdown

ATTOM, Irvine, Calif., said U.S. home sellers nationwide realized a $112,000 profit on the typical sale last year, up 21 percent from $92,500 in 2021 and up 78 percent from two years ago.

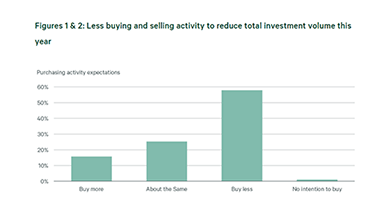

CBRE: Real Estate Investors Targeting Secondary Markets, Opportunistic Strategies

U.S. commercial real estate investors favor opportunistic strategies and show a preference for secondary markets amid concerns about higher interest rates and tighter financial market conditions, reported CBRE, Dallas.

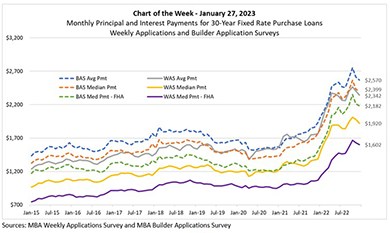

MBA Chart of the Week, Jan. 27, 2023: Monthly Principal, Interest Payments

In the most recent MBA Purchase Applications Payment Index (PAPI) release, MBA Research introduced a new measure—The Builders’ Purchase Applications Payment Index (BPAPI). While PAPI uses MBA’s Weekly Applications Survey purchase data to calculate mortgage payments, BPAPI uses analogous MBA Builder Applications Survey data to create an index that measures how new mortgage payments vary across time relative to income, with a focus exclusively on newly built single-family homes.