MBA Statement on the Veterans Affairs Voluntary Foreclosure Moratorium

MBA’s President and CEO Bob Broeksmit, CMB, released a statement on the Department of Veterans Affairs’ (VA) voluntary foreclosure moratorium.

MBA: Commercial Mortgage Delinquency Rates Increased in Third Quarter

Commercial mortgage delinquencies increased in the third quarter, according to the Mortgage Bankers Association’s latest Commercial Delinquency Report.

MBA Chart of the Week: CRE Delinquencies and Net YTD Charge-offs at FDIC-Insured Firms

Since March 2023, a recurring set of questions has revolved around a) how conditions in commercial real estate are affecting banks and b) how conditions with banks are affecting CRE.

FHFA Announces Increase to Conforming Loan Limit Values for 2024

The Federal Housing Finance Agency raised the conforming loan limit values for mortgages to be acquired by Fannie Mae and Freddie Mac for one-unit properties to $766,550 in 2024, an increase of $40,350 from 2023.

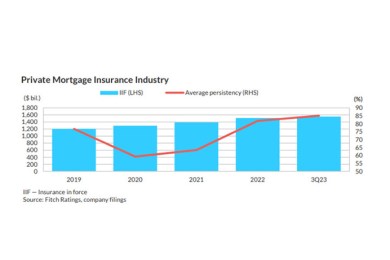

Fitch: 2024 Outlook for Mortgage Insurers Revised to Neutral

Fitch Ratings, New York, has revised its 2024 sector outlook for U.S. mortgage insurers to neutral. Previously the outlook had it at deteriorating.

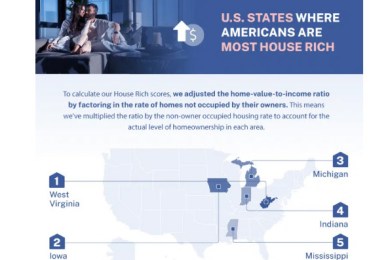

All Star Home: West Virginia Most “House Rich” State

All Star Home, Raleigh, N.C., sought to figure out what state is the most “house rich,” a status it defined as homeownership being dominant and homes being relatively affordable compared to the local median income. Per its analysis, West Virginia took the top spot.