MBA: Home Equity Lending Volume Rose in 2022 as Home Renovations Drive Demand

Originations of open-ended Home Equity Lines of Credit and closed-end home equity loans increased 50% in 2022 compared to two years earlier. This is according to the Mortgage Bankers Association’s Home Equity Lending Study, released for the first time since 2020.

Banking Agencies Issue MBA-Opposed Proposed Changes to Bank Capital Requirements

The Federal Reserve, Federal Deposit Insurance Corporation, and Office of the Comptroller of the Currency on Thursday issued interagency proposed changes to capital requirements for banks with assets of $100 billion or more. MBA strongly opposes certain provisions of the proposal.

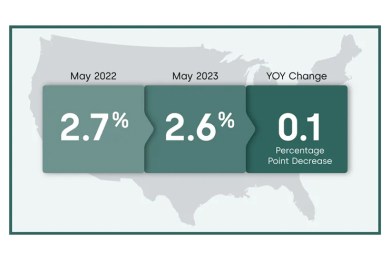

CoreLogic: Mortgage Delinquency Rate at Record Low in May

CoreLogic, Irvine, Calif., reported in May just 2.6% of all mortgages in the U.S. were in some stage of delinquency, matching the all-time low.

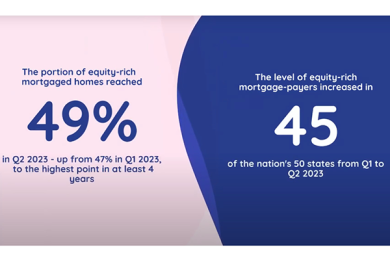

Homeowner Equity Improves in Second Quarter

ATTOM, Irvine, Calif., reported nearly half–49%–of mortgaged residential properties in the United States were considered equity-rich in the second quarter, up from 47% in early 2023.