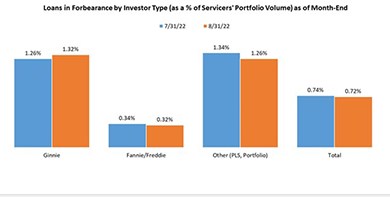

MBA: August Share of Mortgage Loans in Forbearance Falls to 0.72%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans now in forbearance decreased by 2 basis points from 0.74% of servicers’ portfolio volume in the prior month to 0.72% as of August 31. MBA estimates 360,000 homeowners are in forbearance plans.

MBA: 2Q Commercial/Multifamily Mortgage Debt Outstanding Up by $99.5B

Commercial/multifamily mortgage debt outstanding increased by $99.5 billion (2.3 percent) in the second quarter, the Mortgage Bankers Association said in its quarterly Commercial/Multifamily Mortgage Debt Outstanding report.

#MBARMQA22: Risk Management Executive Perspectives

Mortgage executives here at the MBA Risk Management, QA and Fraud Prevention Forum offered insights on leading their organizations through today’s lending environment, maintaining quality operations, managing credit risk and governing organizations in unpredictable times.

#MBARMQA22: When Good Fraud Investigations Go Bad

NASHVILLE, TENN.—Kip Mendrygal, Partner with Locke Lord LLP, Dallas, says he’s seen a lot of weird stuff in his 20-plus years of investigating mortgage fraud.

#MBARMQA22: Strategies for Detecting Fraud

NASHVILLE, TENN.—The current mortgage fraud environment is evolving, with new risks emerging in a post-pandemic environment, analysts said here at the MBA Risk Management QA and Fraud Prevention Forum.

#MBARMQA22: Focusing on the Weakest Links

NASHVILLE, TENN.—The housing market today is nothing like 2008, said Christa Lynn Greco, IA with the Criminal Investigative Division of the Federal Bureau of Investigation, Washington, D.C. But she said changing market conditions make the potential for mortgage fraud ever-present.