MBA Forecast: Recession Likely in 2023, Mortgage Originations to Decline 9% to $2.05 Trillion

NASHVILLE—The Mortgage Bankers Association said total mortgage origination volume is expected to decline to $2.05 trillion in 2023 from the $2.26 trillion expected in 2022. Purchase originations are forecast to decrease by 3 percent to $1.53 trillion next year, while refinance volume is anticipated to decline by 24 percent to $513 billion.

#MBAAnnual22: Ginnie Mae, FHFA, FHA Go Big

NASHVILLE—Presentations by government agencies at major events such as the Mortgage Bankers Association’s Annual Convention & Expo can be pretty staid affairs. Not so this year. On Monday, Ginnie Mae, the Federal Housing Finance Agency and FHA made one major announcement after the other, literally creating their own news cycle.

MISMO Seeks Public Comment on New Flood Risk Disclosure Resource Guide

MISMO®, the real estate finance industry standards organization, seeks public comment on a new Flood Risk Disclosure Resource Guide. The guide is designed to help homeowners and industry participants understand potential flood risks by listing publicly available resources, factors, and information that may be useful.

Ginnie Mae Delays Issuers’ Risk-Based Capital Requirement to Dec. 2024

Ginnie Mae on Friday said it would extend its mandatory implementation date of its risk-based capital requirement by one additional year, to Dec. 31, 2024.

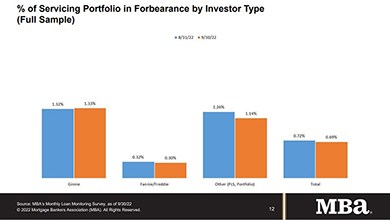

MBA: September Share of Mortgage Loans in Forbearance Decreases to 0.69%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 3 basis points to 0.69% of servicers’ portfolio volume as of Sept. 30, down from 0.72% in August. MBA estimates 345,000 homeowners remain in forbearance plans.