Servicing22: ‘The Most Essential Work in Mortgage Finance’

ORLANDO—The Mortgage Bankers Association’s Servicing Solutions Conference & Expo is live and in person for the first time since 2020. MBA Chair Kristy Fercho opened the Conference by acknowledging the challenging environment servicers have faced during that period.

MBA Economists: Outlook Strong for Originations, Servicing

ORLANDO—Despite another potentially economy-altering event this week—this time, the Russian invasion of Ukraine—Mortgage Bankers Association economists said the current picture for mortgage originators and servicers remains upbeat.

Servicing22: Building Resiliency for Crisis Preparedness

ORLANDO—Perhaps more than any other segment of the real estate finance industry, mortgage servicing had to adapt to the impact of the coronavirus pandemic.

Servicing22: How the Pandemic Made Government Loan Programs More Nimble

ORLANDO—Perhaps the most innovative adaption in the real estate finance industry during the coronavirus pandemic came not from the mortgage industry itself, but from the historically least agile sector—government loan programs.

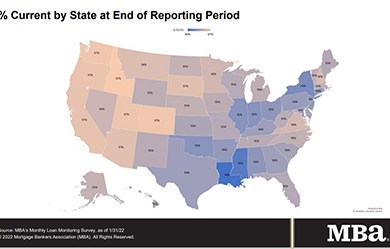

MBA: Share of Mortgage Loans in Forbearance Drops to 1.30%

Loans in forbearance fell again in January to pre-pandemic lows, the Mortgage Bankers Association reported on Monday.

FHFA Issues Final Rule Amending GSE Regulatory Capital Framework

The Federal Housing Finance Agency on Feb. 25 published a final rule that amends the Enterprise Regulatory Capital Framework by refining the prescribed leverage buffer amount and risk-based capital treatment of retained credit risk transfer exposures for Fannie Mae and Freddie Mac.

FHFA Re-Proposes Updated Eligibility Requirements for Enterprise Single-Family Seller/Servicers

The Federal Housing Finance Agency on Thursday re-proposed minimum financial eligibility requirements for Fannie Mae and Freddie Mac seller/servicers.