MISMO Issues Reporting Guide on Forbearance Data Exchange

MISMO®, the real estate finance industry standards organization, launched a new guide and sample credit response to help industry professionals using MISMO Reference Models v3.4 and v3.5 better report on loans that have been in or are in forbearance.

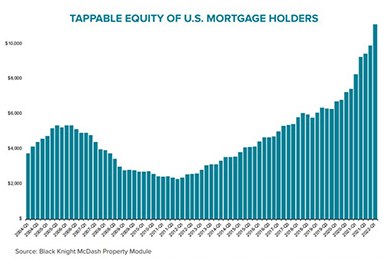

Mortgage Holders Gain $1.2 Trillion in 1Q Tappable Equity

The least-affordable housing market in nearly two decades provides at least one windfall—the average home has gained nearly 9 percent in value since just the start of 2022, with homeowners gaining more than $1.2 trillion in equity in the first quarter, said Black Knight, Jacksonville, Fla.

‘Zombie’ Properties Increase Amid Jump in Foreclosure Activity

ATTOM, Irvine, Calif., said residential properties in the process of foreclosure rose by nearly 13 percent in the second quarter and by nearly 16 percent from a year ago.

Redfin: Homes with High Fire Risk Sell for More as Americans Flock to Fire-Prone Areas

Redfin, Seattle, said its analysis of homes for sale in high fire-risk areas found the median sale price of U.S. homes with high fire risk was $550,500 in April, compared with $431,300 for homes with low fire risk—a difference of nearly $120,000.

FHFA Publishes Final Rule on GSE Capital Plans

The Federal Housing Finance Agency published a final rule that supplements the Enterprise Regulatory Capital Framework by requiring Fannie Mae and Freddie Mac to submit annual capital plans to the Agency and provide prior notice for certain capital actions.

FHFA Releases GSE 2021 Mission Report

The Federal Housing Finance Agency released its annual Mission Report that describes Fannie Mae, Freddie Mac and Federal Home Loan Bank activities to increase access to financing for economic development and affordable, equitable and sustainable housing.