FHFA, GSEs Detail Equitable Housing Finance Plans

The Federal Housing Finance Agency on Wednesday offered details of the government-sponsored enterprises’ Equitable Housing Finance Plans for 2022-2024.

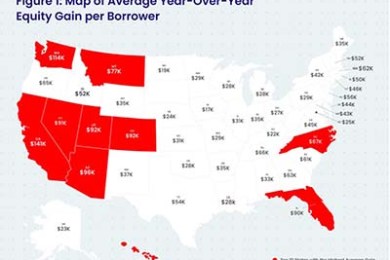

1Q Homeowner Equity Gains Top $60,000 Amid Rapid Home Price Growth

CoreLogic, Irvine, Calif., reported U.S. homeowners with mortgages saw their equity increase by 32.2% year over year, representing a collective equity gain of $3.8 trillion and an average gain of $63,600 per borrower.

2nd Home Hotspots See Outsized Growth in Rental, Home Prices

As remote work prompted many Americans to relocate during the pandemic, housing costs soared in second-home hotspots even more than the rest of the country, according to Redfin, Seattle.

Fitch: Retail Resolutions Drive May U.S. CMBS Loan Delinquency Rate Lower

Fitch Ratings, New York, reported the U.S. commercial mortgage-backed securities delinquency rate fell by 22 basis points to 2.10% in May, amid strong retail resolution volume and robust new issuance.

MISMO Issues Reporting Guide on Forbearance Data Exchange

MISMO®, the real estate finance industry standards organization, launched a new guide and sample credit response to help industry professionals using MISMO Reference Models v3.4 and v3.5 better report on loans that have been in or are in forbearance.