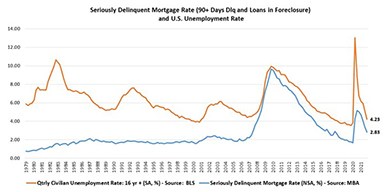

Mortgage Delinquencies Near Pre-Pandemic Lows

Delinquency rates for mortgage loans on one-to-four-unit residential properties continued to trend downward, nearing historic lows last seen before the coronavirus pandemic, the Mortgage Bankers Association reported Thursday.

Wells Fargo Leads MBA 2021 Year-End Commercial/Multifamily Servicer Rankings

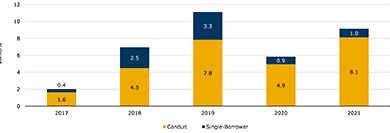

SAN DIEGO — The Mortgage Bankers Association released its year-end ranking of commercial and multifamily mortgage servicers’ volumes as of December 31.

MBA: 2022 Commercial/Multifamily Mortgage Maturity Volumes to Increase 12 Percent

SAN DIEGO — The Mortgage Bankers Association said $248.8 billion of the $2.6 trillion (12 percent) of outstanding commercial and multifamily mortgages held by non-bank lenders and investors will mature in 2022, a 12 percent increase from the $222.5 billion that matured in 2021.

MBA Servicing Solutions Conference & Expo in Orlando Feb. 22-25

The Mortgage Bankers Association’s Servicing Solutions Conference & Expo 2022 takes place Feb. 22-25 at the Hyatt Regency Orlando.

ATTOM: Foreclosure Activity at Nearly 2-Year High

ATTOM, Irvine, Calif., reported 23,204 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — up 29 percent from a month ago and 139 percent from a year ago to its highest level since onset of the coronavirus pandemic.

Real Estate Investor Purchases Up 40% From Year Ago

Real estate investor purchases accounted for 16.4% of all home purchases nationally in the third quarter from 11.7% a year ago, an increase of more than 40 percent, reported RealtyTrac, Irvine, Calif.