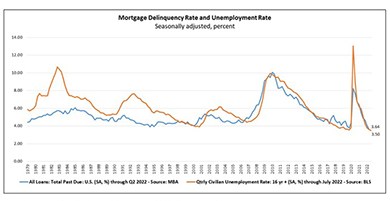

MBA: 2Q Mortgage Delinquency Rate at Record Low

The second quarter mortgage delinquency rate fell to a record low—even beating out pre-pandemic lows—the Mortgage Bankers Association reported Thursday.

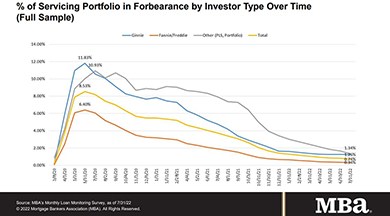

July Mortgage Loan Forbearance Rate Falls to 0.74%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 7 basis points to 0.74% of servicers’ portfolio volume as of July 31, from 0.81% in June. MBA estimates 370,000 homeowners remain in forbearance plans.

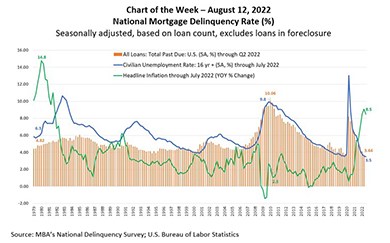

MBA Chart of the Week, Aug. 12, 2022: National Mortgage Delinquency Rate

This week’s MBA Chart of the Week highlights the relationship between MBA’s mortgage delinquency rate and two economic indicators, the unemployment rate, and year-over-year changes in headline inflation – measuring the price of goods and services in the economy.

Reports Show Drops in Delinquencies, Foreclosures

Reports from CoreLogic, Irvine, Calif., and ATTOM, Irvine, show declines in both mortgage delinquencies and foreclosure activity.

FHFA Announces Update for Services to Maintain Fair Lending Data

The Federal Housing Finance Agency on Wednesday announced Fannie Mae and Freddie Mac will require servicers to obtain and maintain fair lending data on their loans, and for this data to transfer with servicing throughout the mortgage term.

Ginnie Mae Outlines Plan to Fight Housing Costs, Boost Housing Supply

Ginnie Mae on Wednesday said it will take on a larger role in HUD’s efforts to fight rising housing costs and boost housing supply, releasing a Fact Sheet outlining its efforts to drive liquidity toward equitable and affordable housing.