RCA: Pandemic Loan Loss Rates Below Great Recession Extremes

Real Capital Analytics, New York, said the losses taken by lenders on previously defaulted commercial real estate loans remain far below the loss rates seen during the Great Recession.

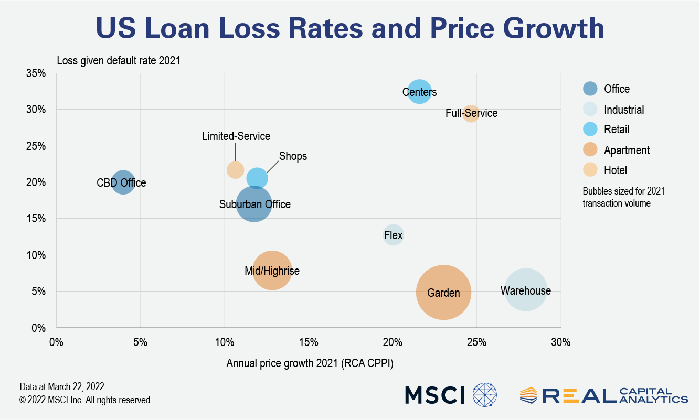

Alexis Maltin, Real Capital Analytics Head of Americas Real Estate Research, said average loss rates across the five primary commercial property types reached 36 percent in 2010, with hotel and retail posting the highest rates. But lenders saw only an average 19 percent loss in value from the initial loan amount last year, she noted.

“It is possible we have not seen the worst of the losses as economic uncertainty tied to the pandemic and the crisis in Ukraine still loom,” Maltin said. “So far, however, the availability of debt and pent-up investor demand have helped buoy prices. This price growth has offered lenders some downside protection in the event of a default.”

RCA said its National All-Property Price Index increased 19.4 percent between February 2021 and February 2022.

Loss rates on loans tied to offices fell furthest from last year, Maltin said. Loss rates for central business district offices equal 20 percent and the suburban office asset loss rate stands at 17 percent. Though price growth for downtown assets turned positive last year after dipping in 2020, suburban office price growth was far greater.

“Shopping centers and full-service hotels stand out from the pack in that price growth and loss rates appear to be unrelated,” Maltin said. “The lack of correlation is a function of those assets within these subtypes that are driving each metric.”

Maltin noted the largest shopping center losses were tied to mall assets while grocery-anchored and unanchored centers are driving price growth at the moment. “Price growth for full-service hotels has been driven by leisure-focused assets, such as resorts, while the defaulted assets experiencing losses are largely oriented towards the budget conscious or business traveler,” she said.