MBA Announces Policy Initiative to Close Racial Homeownership Gap

The Mortgage Bankers Association on Monday announced a policy initiative, Building Generational Wealth Through Homeownership, aimed at providing industry leadership and direction for reducing the racial homeownership gap, developing and supporting policies that support sustainable homeownership for communities of color and promoting fair, equitable and responsible lending for minority borrowers.

MBA CONVERGENCE Environmental Scan Examines Affordable Rental Housing Challenges, Opportunities

MBA CONVERGENCE, the national strategy by the Mortgage Bankers Association to bring together lenders, community leaders and public officials for new solutions to America’s affordable housing challenges, this week released an Environmental Scan examining affordability challenges in rental housing markets.

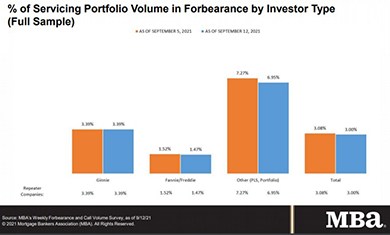

Share of Mortgage Loans in Forbearance Falls to 3.00%

Mortgage loans in forbearance fell to yet another post-pandemic low and threatened to fall under 3 percent for the first time in more than a year and a half, the Mortgage Bankers Association reported on Monday.

FHFA Issues Proposed Rulemaking to Amend GSE Regulatory Capital Framework

It’s been a busy week for the Federal Housing Finance Agency. On Tuesday, FHFA and the Treasury Department suspended certain provisions added to the Preferred Stock Purchase Agreements with Fannie Mae and Freddie Mac. On Wednesday, FHFA announced a notice of proposed rulemaking to amend the Enterprise Regulatory Capital Framework for Fannie Mae and Freddie Mac.

FHFA, Treasury Suspend Portions of GSE 2021 Preferred Stock Purchase Agreements

The Federal Housing Finance Agency and the Treasury Department on Sept. 14 suspended certain provisions added to the Preferred Stock Purchase Agreements with Fannie Mae and Freddie Mac in January.