Broeksmit: MBA Focused on Regulatory Issues

WASHINGTON—Mortgage Bankers Association President & CEO Robert Broeksmit, CMB, told attendees here at the MBA Regulatory Compliance Conference as Congress and the Biden Administration put plans into shape, the Association will continue to seek balance and advocate for the real estate finance industry.

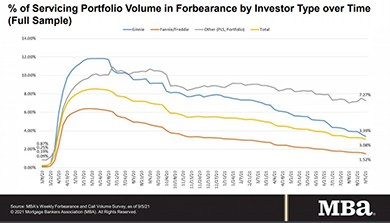

Share of Mortgage Loans in Forbearance Drops to 3.08%

Forbearance exits saw their fastest pace since March, the Mortgage Bankers Association reported Monday afternoon in its weekly Forbearance and Call Volume Survey.

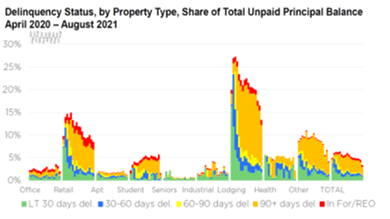

MBA: Commercial, Multifamily Delinquencies Continue Downward Trend

Delinquency rates of mortgages backed by commercial and multifamily properties have broadly improved in recent months, according to two new Mortgage Bankers Association reports.

Biden Nominates Alanna McCargo to Head Ginnie Mae

The Biden Administration on Monday nominated Alanna McCargo as President of Ginnie Mae. The Mortgage Bankers Association issued a statement in support.

Ida Losses at $16 – $24 Billion in Insured, Uninsured Flood Losses in Northeast

CoreLogic, Irvine, Calif., released additional loss estimates for Hurricane Ida, following its initial release estimating between $27 billion and $40 billion in insured and uninsured losses from wind, storm surge and inland flooding in Louisiana and Mississippi.

FHFA Announces Equitable Housing Finance Plans for GSEs

The Federal Housing Finance Agency announced Tuesday that Fannie Mae and Freddie Mac will submit Equitable Housing Finance Plans by the end of 2021.

Foreclosure Activity Increases after Moratorium Ends

Foreclosure activity increased significantly in August after the federal foreclosure moratorium ended July 31, reported ATTOM, Irvine, Calif.