Final MBA Forbearance & Call Volume Survey: Mortgage Loans in Forbearance Drops to 2.06%

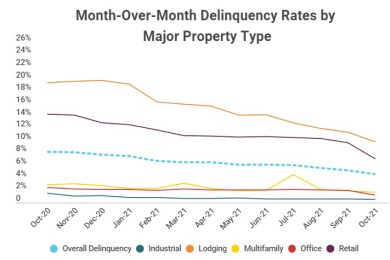

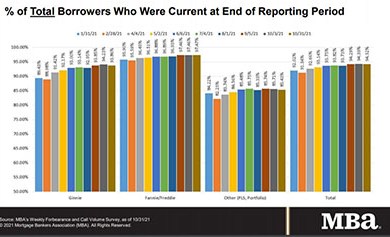

The Mortgage Bankers Association issued its final Forbearance and Call Volume Survey on Monday; 77 weeks after its first survey, MBA reported one million homeowners in forbearance plans, down from more than six million in mid-2020.

MBA, Trade Groups Urge Senate Banking Committee to Approve LIBOR ‘Tough Legacy’ Legislation

The Mortgage Bankers Association and nearly two dozen industry trade groups urged members of the Senate Banking Committee to support federal legislation to address “tough legacy” contracts that currently reference LIBOR.

Auction.com: Completed 3Q Foreclosure Auctions Up 16%

Auction.com, Irvine, Calif., said completed foreclosure auctions in the third quarter increased by 16 percent from the previous quarter and by 89 percent from a year ago to a new pandemic high.

Gen Z Drives Strong Q3 Credit Activity

The credit card industry is rebounding strongly from the early impacts of the COVID-19 pandemic, said TransUnion, Chicago, with Gen Z leading the way in terms of originations and bankcard balance growth and other credit categories, including mortgage.

CFPB: Credit Report Disputes More Common in Minority Neighborhoods

The Consumer Financial Protection Bureau released research reporting consumers in majority Black and Hispanic neighborhoods, as well as younger consumers and those with low credit scores, are far more likely to have disputes appear on their credit reports.