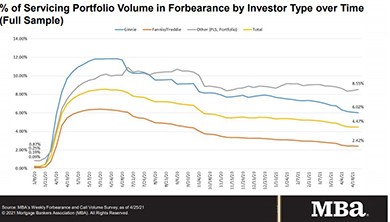

Share of Mortgage Loans in Forbearance Down 9th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 2 basis points to 4.47% of servicers’ portfolio volume as of April 25 from 4.49% in the prior week, the ninth straight weekly decrease. MBA estimates 2.23 million homeowners are in forbearance plans.

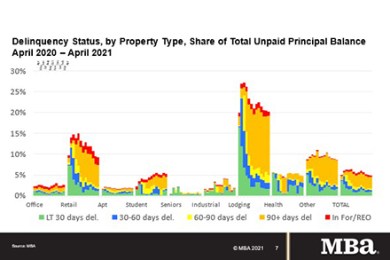

MBA: April Commercial/Multifamily Mortgage Delinquencies Decline

Delinquency rates for mortgages backed by commercial and multifamily properties decreased again in April, reaching the lowest level since the onset of the COVID-19 pandemic, the Mortgage Bankers Association’s latest monthly CREF Loan Performance Survey reported.

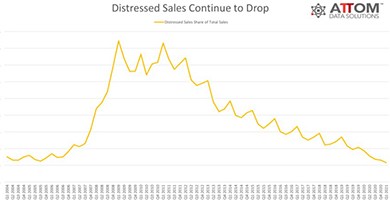

Black Knight: Delinquencies at Record Low: MBA to Release National Delinquency Survey Friday

Ahead of this Friday’s release of the Mortgage Bankers Association’s 1st Quarter National Delinquency Survey, Black Knight, Jacksonville, Fla., said just 217,000 homeowners became past due on their mortgages in March, the lowest such delinquency inflow of any month on record.

FHFA Publishes Final Rule on GSE ‘Living Wills’

The Federal Housing Finance Agency on Monday published a final rule that requires Fannie Mae and Freddie Mac to develop credible resolution plans, also known as “living wills.”

FHFA Announces New Refi Option for Low-Income Borrowers with GSE-Backed Mortgages

The Federal Housing Finance Agency on Wednesday announced Fannie Mae and Freddie Mac will implement a new refinance option for low-income borrowers with government-sponsored enterprise-backed single-family mortgages.