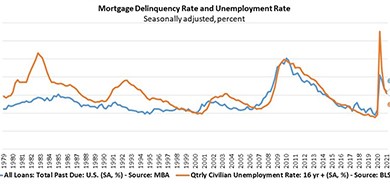

MBA: 1Q Mortgage Delinquencies Continue to Drop

The Mortgage Bankers Association on Friday reported the delinquency rate for mortgage loans on one-to-four-unit residential properties fell to 6.38 percent of all loans outstanding, seasonally adjusted, at the end of the first quarter.

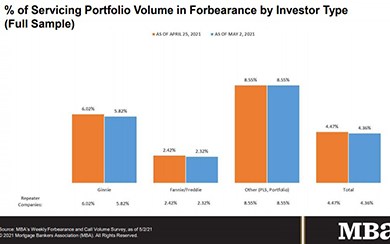

MBA: Loans in Forbearance Fall 10th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 11 basis points to 4.36% of servicers’ portfolio volume as of May 2 from 4.47% the prior week–the 10th consecutive week of declines. MBA estimates 2.2 million homeowners are in forbearance plans.

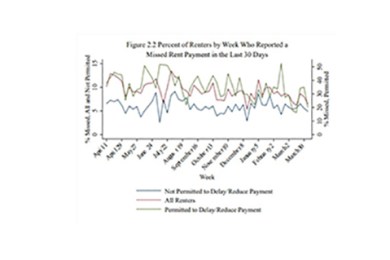

RIHA: Less Than 10% of Homeowners, Renters Have Missed Multiple Payments During Pandemic

Slightly under five million households did not make their rent or mortgage payments in March, an improvement from December 2020 and the lowest number since the onset of the COVID-19 pandemic, new research from the Mortgage Bankers Association’s Research Institute for Housing America reported.

CFPB Reports Detail Mortgage Borrowers’ Continuing COVID-19 Challenges

The Consumer Financial Protection Bureau released two reports Tuesday, saying more work needs to be done to help mortgage borrowers coping with the COVID-19 pandemic and economic downturn.

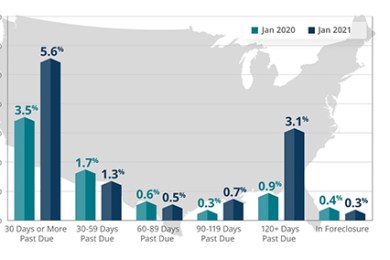

CoreLogic: Mortgage Delinquency Rates Level Off in February

Despite a small uptick in overall delinquencies, serious delinquencies continued to decrease, CoreLogic, Irvine, Calif., reported this morning.