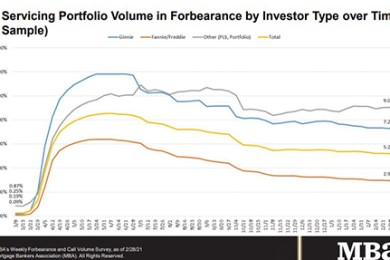

MBA: Share of Mortgage Loans in Forbearance Decreases to 5.20%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 3 basis points to 5.20% of servicers’ portfolio volume as of February 28 from 5.23% the previous week. MBA estimates 2.6 million homeowners are in forbearance plans.

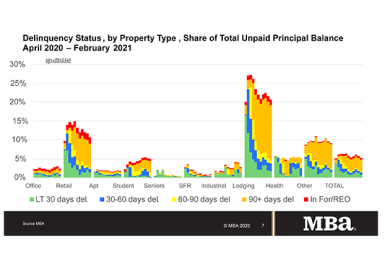

MBA: February Commercial, Multifamily Mortgage Delinquency Rates Decrease

Delinquency rates for mortgages backed by commercial and multifamily properties decreased in February, as the COVID-19 pandemic’s impact on commercial and multifamily mortgage performance continues to vary by the different types of commercial real estate, the Mortgage Bankers Association reported Thursday.

CFPB Proposes Delay of QM Final Rule Mandatory Compliance Date to Oct. 2022

The Consumer Financial Protection Bureau on Wednesday issued a notice of proposed rulemaking to delay the mandatory compliance date of the General Qualified Mortgage final rule by more than a year, from July 1 to Oct. 1, 2022.

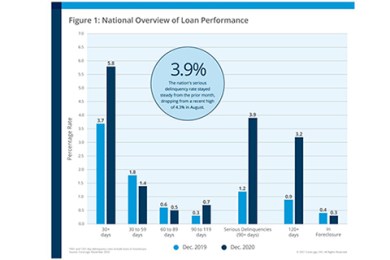

2020 Mortgage Delinquencies See Record Highs—and Record Lows

CoreLogic, Irvine, Calif., said its year-end Loan Performance Insights Report showed overall mortgage delinquency rates fell for the fourth straight month in December, ending a volatile year with signs of recovery.