MBA: IMB Production Profits Remain Strong in Fourth Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $3,738 on each loan they originated in the fourth quarter down from a reported gain of $5,535 per loan in the third quarter, according to the Mortgage Bankers Association’s latest Quarterly Mortgage Bankers Performance Report.

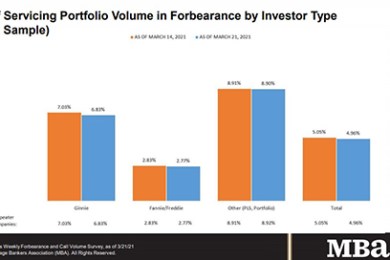

MBA: Share of Loans in Forbearance Hit Pandemic-Era Low

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 9 basis points to 4.96% of servicers’ portfolio volume as of March 21 from 5.05% the week before. This marks the fourth consecutive week of decreases. MBA estimates 2.5 million homeowners are in forbearance plans.

MBA, Trade Groups Urge Support of Housing Supply & Affordability Act

The Mortgage Bankers Association and a broad coalition of more than 100 national and regional trade associations and community support groups urged Congress to pass S. 5061, the Housing Supply and Affordability Act, a bipartisan bill that would authorize $1.5 billion over five years for federal grants to local governments that commit to increase their supply of local housing.

A Conversation with MBA Affordable Housing Advisory Council Co-Chairs

The Mortgage Bankers Association recently created two Affordable Advisory Councils, dedicated to supporting CONVERGENCE, the MBA Affordable Housing Initiative. These Councils are currently led by four senior executives: Christine Chandler (M&T Realty Capital Corp.), Tony Love (Bellwether Affordable Housing Group), Anthony Weekly (Truist Bank) and David Battany (Guild Mortgage).