MBA Expresses Concerns over GSE Limits on Second Homes, Investor Properties

The Mortgage Bankers Association said it is concerned over new limits on loan deliveries for second homes and investor properties by Fannie Mae and Freddie Mac.

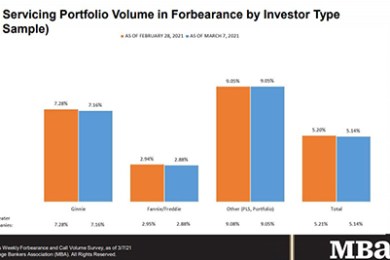

MBA: Share of Mortgage Loans in Forbearance Decreases to 5.14%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 5.14% of servicers’ portfolio volume as of March 7 from 5.20% the prior week. MBA estimates 2.6 million homeowners are in forbearance plans.

Sen. Toomey Issues Housing Finance Reform Principles

Sen. Pat Toomey, R-Pa., ranking member of the Senate Banking Committee, yesterday released a set of guiding principles for housing finance reform, a move welcomed by the Mortgage Bankers Association.

MBA Letters Address GSE Liquidity Requirements, ‘Living Wills’

The first letter offers recommendations on how FHFA can improve its framework for codifying new liquidity requirements for Fannie Mae and Freddie Mac. The second letter addresses an FHFA proposal to require Fannie and Freddie to develop and maintain “living wills” in the event one or both of them becomes insolvent.

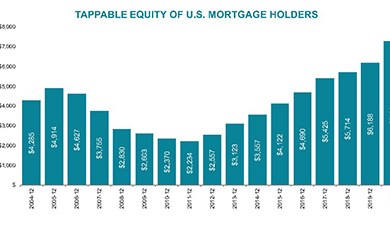

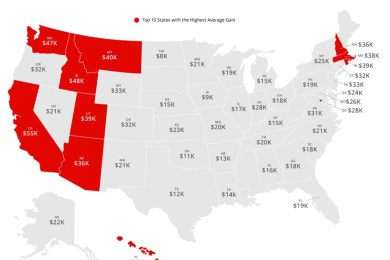

Despite Home-Equity Uptick, Black American Median Home Values Lag Behind

Despite promising data showing substantial gains in home equity, Black Americans still lag well behind other demographic cohorts, according to a new report from Redfin, Seattle.

CFPB: Discrimination Illegal by Lenders on Basis of Sexual Orientation, Gender Identity

The Consumer Financial Protection Bureau on Mar. 9 issued an interpretive rule clarifying that prohibition against sex discrimination under the Equal Credit Opportunity Act and Regulation B includes sexual orientation discrimination and gender identity discrimination.