2020 Mortgage Delinquencies See Record Highs—and Record Lows

CoreLogic, Irvine, Calif., said its year-end Loan Performance Insights Report showed overall mortgage delinquency rates fell for the fourth straight month in December, ending a volatile year with signs of recovery.

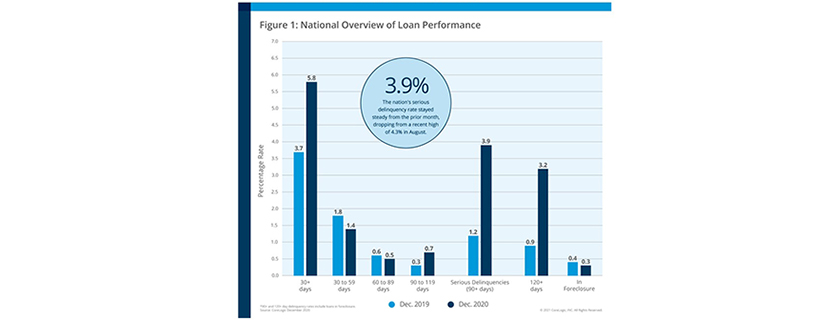

The report said on a national level, 5.8% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure) at the end of December, representing a 2.1-percentage point increase in the overall delinquency rate from a year ago, when it was 3.7%. However, national overall delinquency has been declining month to month since June. Other findings, with year-over-year changes, include:

• Early-Stage Delinquencies (30 – 59 days past due): 1.4%, down from 1.8% in a year ago.

• Adverse Delinquency (60 – 89 days past due): 0.5%, down from 0.6% a year ago.

• Serious Delinquency (90 days or more past due, including loans in foreclosure): 3.9%, up from 1.2% in December 2019.

• Foreclosure Inventory Rate (share of mortgages in some stage of the foreclosure process): 0.3%, down from 0.4% in December 2019.

• Transition Rate (share of mortgages that transitioned from current to 30 days past due): 0.8%, unchanged from December 2019.

Frank Martell, President & CEO of CoreLogic, noted 2020 began with the lowest share of overall delinquencies (30+ days past due) since data recording started in 1999, but as the pandemic and shelter-in-place directives spread, the rate doubled from 3.6% in March to 7.3% in May. As those initially affected by the pandemic and ensuing recession transitioned through stages of delinquency, serious delinquencies (90+ days past due) increased four-fold compared to pre-pandemic rates, peaking in August.

“The ongoing forbearance provisions and economic aid implemented at the start of the pandemic has proved helpful for families faced with financial insecurity,” Martell said.

The report said all U.S. states and nearly all metro areas logged increases in annual overall delinquency rates in December. Hawaii and Nevada (both up 4.1 percentage points) logged the largest annual increase in overall delinquency rates.

Among metros, Odessa, Texas, experienced the largest annual increase with 9.8 percentage points, largely due to significant job loss in the oil industry. Other metro areas with significant overall delinquency increases included Lake Charles, La. (up 7.6 percentage points); Midland, Texas (up 7.5 percentage points) and Kahului, Hawaii (up 6.8 percentage points).