CoreLogic: Strong Improvement in U.S. Mortgage Delinquency Rates

(Graphic courtesy CoreLogic.)

CoreLogic, Irvine, Calif., said just 4.9 percent of all mortgages in the U.S. were in some stage of delinquency, the lowest rate in more than a year.

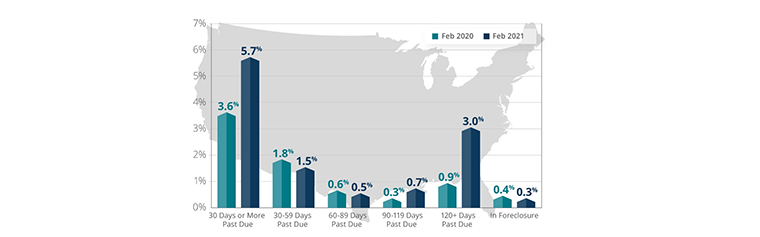

The company’s monthly Loan Performance Insights Report said the March rate represented a 1.3-percentage point increase in overall delinquency rate compared to a year ago. Other key findings:

–Early-Stage Delinquencies (30 to 59 days past due): 1%, down from 1.9% in March 2020.

–Adverse Delinquency (60 to 89 days past due): 0.4%, down from 0.6% in March 2020.

–Serious Delinquency (90 days or more past due, including loans in foreclosure): 3.5%, up from 1.2% in March 2020.

–Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, down from 0.4% in March 2020.

–Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.4%, down from 1% in March 2020.

CoreLogic Chief Economist Frank Nothaft said March marked a “critical juncture” in the U.S. — the one-year anniversary of the onset of the pandemic, the third round and disbursement of government stimulus checks and extension of forbearance programs. Taken together, some of these factors helped mortgage holders stay current on their loans and led to the lowest national delinquency rate in a year in March 2021.

Additionally, Nothaft said, convergence of these financial paddings allowed many homeowners to chip away at other debt. A recent CoreLogic survey of current mortgage holders shows that in addition to 89% of respondents saying they are current on their mortgage payments, nearly 70% said they also have credit card debt — of which, only 15% reported falling behind on payments in the past year.

“Many forces came together in March to yield the largest one-month improvement in the overall delinquency rate since the pandemic started,” Nothaft said. “In addition to continued government support, including stimulus payments and mortgage forbearance programs, the U.S. economy added 770,000 jobs in March, the largest increase since August of 2020.”

“Homeowners are catching up on their debt as the economic effects of the pandemic begin to wane, which is yet another sign of forward motion on the road to overall recovery,” said Frank Martell, president and CEO of CoreLogic.

The report said all U.S. states and nearly all metro areas logged increases in annual overall delinquency rates in March. Hawaii and Nevada (up 3.2 and 3 percentage points, respectively) again logged the largest annual increase in overall delinquency rates in March. Among metros, Odessa, Texas, still recovering from job losses in the oil industry, had the largest annual overall delinquency increase with 7.9 percentage points. Other metro areas with significant overall delinquency increases included Midland, Texas (up 6.1 percentage points); Kahului, Hawaii (up 5.2 percentage points) and Lake Charles, La. (up 4 percentage points).