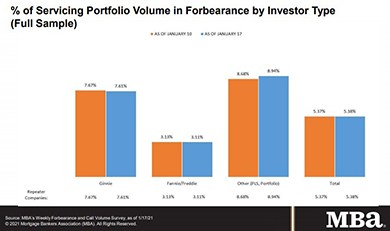

MBA: Share of Mortgage Loans in Forbearance Increases Slightly to 5.38%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased slightly to 5.38% of servicers’ portfolio volume as of Jan. 17 from 5.38% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

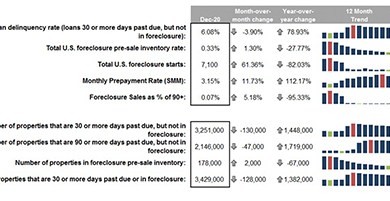

Black Knight First Look: 2020 Ends with Higher Delinquencies, Lower Foreclosures

Black Knight, Jacksonville, Fla., said 2020 ended with 1.54 million more delinquent and 1.7 million more seriously delinquent mortgages than at the start of the year, a looming reminder of the challenges facing the market in 2021.

FHA to Permit DACA-Status Recipients to Apply for FHA-Insured Mortgages

HUD said Jan. 20 it will permit individuals classified under the “Deferred Action for Childhood Arrivals” program (DACA) with the U.S. Citizenship & Immigration Service and are legally permitted to work in the U.S. to apply for mortgages backed by FHA.

CFPB Issues Final Rules Clarifying Role of Supervisory Guidance, Escrow Accounts

In final actions of the Trump Administration, the Consumer Financial Protection Bureau yesterday issued two final rules. The first confirms the Bureau’s use of supervisory guidance for its supervised institutions; the second exempts certain financial institutions from establishing escrow accounts for higher-priced mortgage loans.

TransUnion: Percentage of Consumers with Financial Accommodations Remains Elevated

TransUnion, Chicago, said its latest Financial Services Monthly Industry Snapshot Report shows 2.87% of accounts in the auto, credit card, mortgage or unsecured personal loan industries remained in some form of financial hardship status at the end of December.