RIHA: More Renters, Fewer Homeowners Missed Housing Payments in September, October

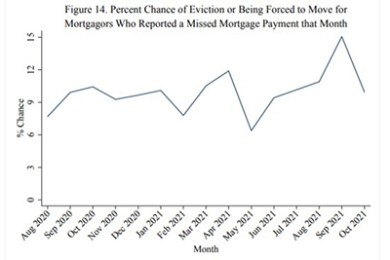

Renters were three times more likely than homeowners to miss payments during September and October, according to updated research released Tuesday by the Mortgage Bankers Association’s Research Institute for Housing America.

MBA: 3Q Commercial/Multifamily Mortgage Delinquency Rates Decrease

Commercial and multifamily mortgage delinquencies declined in the third quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Delinquency Report.

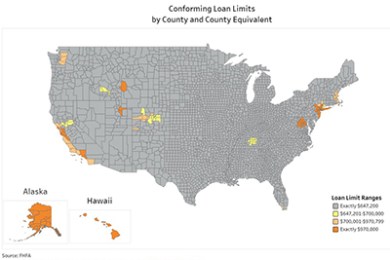

2022 GSE Conforming Loan Limits Rise 18.5% to $647,200

Conforming loan limits for Fannie Mae and Freddie Mac will rise to $647,200 jump in 2022, the Federal Housing Finance Agency said Nov. 30—a jump of nearly $100,000 from 2021’s previous record high.

MBA, Trade Groups Urge HUD to Issue ‘Clear Roadmap’ for Servicers in LIBOR Transition

As HUD considers changes to its index for FHA-insured adjustable-rate mortgages away from LIBOR, the Mortgage Bankers Association and other industry trade groups urged the Department to issue a clear roadmap for servicers of FHA-insured ARMs, including specification of a replacement comparable index or indices for existing mortgages, as well as guidance on communications with borrowers.

RIHA Study: U.S. Household Net Worth Up 17.6% Between 2016-2019

The median net worth of U.S. households increased from $103,000 in 2016 to $127,000 in 2019 – a gain of 17.6% and the highest amount since 2007, according to The Distribution of Wealth in America Since 2016, a new report released Thursday by the Mortgage Bankers Association’s Research Institute for Housing America.

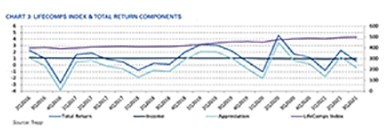

Life Insurance Commercial Mortgages Post Modest Return

Trepp LLC, New York, said commercial mortgage investments held by life insurance companies saw modest returns in the third quarter.