MBA: Pandemic Takes Aim at Commercial, Multifamily Mortgage Delinquency Rates

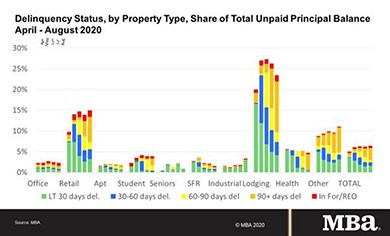

The coronavirus pandemic had a “dramatic and immediate impact” on delinquency rates for some mortgages backed by commercial and multifamily properties in the second quarter, although most continued to perform well, the Mortgage Bankers Association said today in two reports.

MBA Asks FHFA to Develop New GSE Capital Framework

The Mortgage Bankers Association asked the Federal Housing Finance Agency to restructure the capital framework for Fannie Mae and Freddie Mac, moving from past business models to a market utility approach that enables them to meet all of their obligations.

MBA: Share of Mortgage Loans in Forbearance Flat at 7.20%

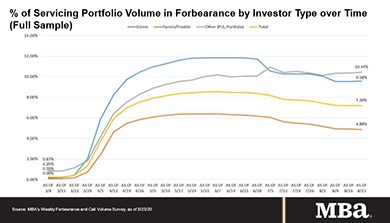

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the percentage of loans in forbearance stayed flat for the second straight week, holding at 7.20% as of Aug. 23.

FHFA Delays Refi Fee Implementation to Dec. 1

The Federal Housing Finance Agency announced Fannie Mae and Freddie Mac would delay implementation of a controversial Adverse Market Refinance Fee by two months, to Dec. 1.

FHFA Extends GSE Forbearance Purchases through Sept. 30; Extends COVID-Related Loan Processing Flexibilities

The Federal Housing Finance Agency announced Wednesday that Fannie Mae and Freddie Mac will extend buying qualified loans in forbearance and several loan origination flexibilities through September 30.

‘Zombie’ Foreclosures on the Rise

ATTOM Data Solutions, Irvine, Calif., said its third quarter Vacant Property and Zombie Foreclosure Report showed 1.5 million residential properties in the United States are vacant, representing 1.6 percent of all homes. Nearly 4 percent of these vacant homes face foreclosure—so-called “zombie foreclosures.”