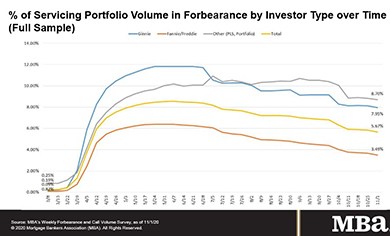

MBA: Share of Mortgage Loans in Forbearance Decreases to 5.67%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 16 basis points to 5.67% of servicers’ portfolio volume as of Nov. 1, from 5.83% the prior week. MBA now estimates 2.8 million homeowners are in forbearance plans.

Broeksmit: ‘MBA Was Made for Times of Crisis’

In remarks yesterday during the Mortgage Bankers Association’s virtual Regulatory Compliance Conference, MBA President & CEO Robert Broeksmit, CMB, said the extraordinary events of 2020 have tested everyone’s mettle—including that of MBA.

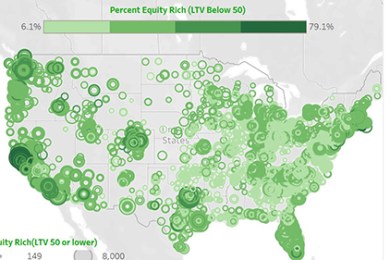

3Q Home Equity Levels Rise Despite Pandemic

ATTOM Data Solutions, Irvine, Calif., said equity-rich properties in the U.S. now outnumber those considered seriously underwater by a nearly 5-1 margin.

CoreLogic: Foreclosures Remain Low; Serious Delinquencies Continue to Build Up

Ahead of this morning’s quarterly National Delinquency Survey from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said the 150-day delinquency rate reached its highest level since January 1999, noting that forbearance provisions have helped foreclosure rates maintain historic lows.

Smaller Metros—and Fewer Disasters—On Home Buyers’ Radar Screens

The coronavirus has caused a sea change in Americans’ attitudes toward home. With millions now working from home—many permanently—they are rethinking everything: how to repurpose rooms; how many cars they need to own; and especially, where they want to live, not where they need to live.