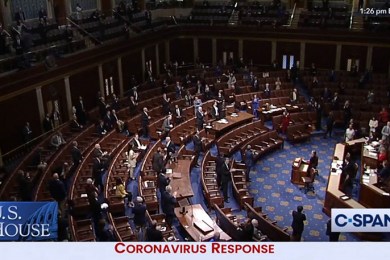

House Approves $2 Trillion Stimulus Bill; Trump Signs into Law

The House on Friday approved a massive $2 trillion stimulus bill aimed at injecting a much-needed boost to a U.S. economy that has been staggered by the coronavirus pandemic.

Ginnie Mae, FHA Update Servicer Policies in Coronavirus Wake

Ginnie Mae and FHA on Friday issued updates addressing mortgage servicer liquidity issues that could result from the coronavirus pandemic.

MBA Raises Concerns with SEC on Broker-Dealer Margin Call Volatility

The Mortgage Bankers Association, in a letter Sunday to the Securities and Exchange Commission and the Financial Industry Regulatory Authority, raised “urgent concern” about dramatic price volatility in the market for agency mortgage-backed securities over the past week that leading to broker-dealer margin calls on mortgage lenders’ hedge positions that are unsustainable for many such lenders.

MBA, Trade Groups Ask DHS to Declare Housing ‘Essential Infrastructure Business’

The Mortgage Bankers Association joined more than 90 industry trade groups in a letter to the Department of Homeland Security, urging DHS to designate construction of single-family and multifamily housing as an “Essential Infrastructure Business.”

MBA, Trade Groups Petition FCC for ‘Emergency Purposes Exception’ on Mortgage Servicing Calls

The Mortgage Bankers Association joined other industry trade groups in a letter Monday to the Federal Communications Commission, arguing that mortgage servicing calls (and other financial institution notices) should be deemed emergency calls by the FCC and exempt from the Telephone Consumer Protection Act during the COVID19 emergency.

MBA, Trade Groups Outline Challenges Facing Borrowers Amid COVID-19

The Mortgage Bankers Association and a half-dozen industry trade groups last week sent a letter to the White House and other government agencies discussing concerns and challenges facing homeowners in paying their mortgage due to the COVID-19 crisis.

Crapo Urges Treasury, Fed for Quick Guidance on Title IV of CARES Act

Senate Banking Committee Chairman Mike Crapo, R-Idaho urged the Treasury Department and the Federal Reserve to act quickly to provide guidance on Title IV of the Coronavirus Aid, Relief and Economic Security (CARES) Act, which was signed into law Friday.