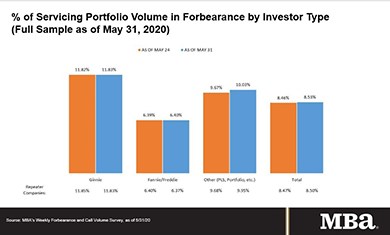

MBA Survey: Share of Mortgage Loans in Forbearance Slows to 8.53%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 8.53% of mortgage servicers’ portfolio volume as of May 31, compared to 8.46% the prior week.

MBA: IMBs Report Strong First Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $1,600 on each loan they originated in the first quarter, up from $1,182 per loan in the fourth quarter, according to the Mortgage Bankers Association’s newly released Quarterly Mortgage Bankers Performance Report.

(#MBALive) Cybersecurity in a Remote-Work Environment

Security worries have grown as more people work remotely due to the pandemic, so it is more important than ever to consider security considerations for the teleworking environment.

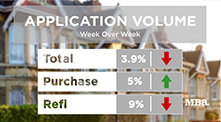

(#MBA Live) Housing, Mortgage Markets Show Resiliency, Agility

With all that has hit the mortgage industry over the past several months, Mortgage Bankers Association Chief Economist Mike Fratantoni has a positive message for mortgage lenders and servicers: “It seems like the industry has done a fantastic job of finding solutions in this crazy environment,” Fratantoni said during MBA Live: Technology Solutions Conference.

FHFA Announces Next Steps for GSE UMBS Pooling Practices

The Federal Housing Finance Agency yesterday directed Fannie Mae and Freddie Mac to “further align their practices for evaluating seller and servicer prepayment related activities.”

FHA, CFPB Issue New Guidance on Forbearance

The Federal Housing Administration and the Consumer Financial Protection Bureau announced new policies to assist mortgage borrowers impacted by the economic effects of the coronavirus pandemic.