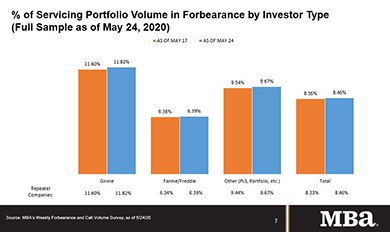

MBA: Share of Mortgage Loans in Forbearance Increases to 8.46%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 8.46% of servicers’ portfolio volume from 8.36% the prior week as of May 24. MBA estimates 4.2 million homeowners are now in forbearance plans.

California County Ends Controversial PACE Loan Program

Forget the coronavirus—if you want to raise the blood pressure of a mortgage lender or servicer, just say these two words: “PACE loan.”

To the Point with Bob: FHFA’s Capital Rule and How it Fits into Housing Finance Reform

Mortgage Bankers Association President and CEO Robert Broeksmit, CMB, in his newest blog, discusses latest developments involving the Federal Housing Finance Agency and its re-proposed capital framework for Fannie Mae and Freddie Mac.

‘Zombie’ Property Stats Hold Steady Amid Foreclosure Moratorium

ATTOM Data Solutions, Irvine, Calif., said the percentage of “zombie” properties—vacant properties facing foreclosure—held steady in the second quarter as nationwide moratoria on foreclosures kept activity to a minimum.