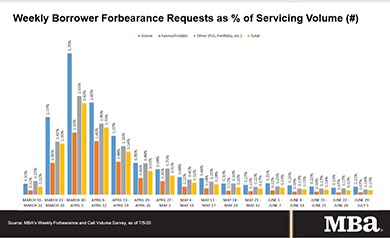

MBA: Share of Loans in Forbearance Falls 4th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 21 basis points to 8.18% of servicers’ portfolio volume for the week of July 5, from 8.39% the week before. MBA now estimates 4.1 million homeowners are in forbearance plans, down from 4.2 million the previous week.

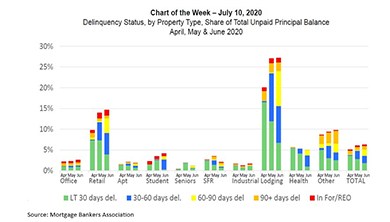

MBA Chart of the Week: Delinquency Status of Unpaid Principal Balance 2nd Quarter

The $3.7 trillion commercial and multifamily mortgage market is really a confederation of different capital sources, property types and geographic markets, all bound together by the provision of mortgage capital backed by investment property incomes and collateral value. Often, the overall market moves in tandem. At other times – like now – different segments act very differently.

Fitch Ratings: Coronavirus Sparks Largest-Ever CMBS Delinquencies Rate Jump

June saw the largest month-over-month increase in the commercial mortgage-backed securities delinquency rate in more than 15 years, reported Fitch Ratings, New York.

FHFA Extends GSE Loan Processing Flexibilities Through Aug. 31

The Federal Housing Finance Agency announced Fannie Mae and Freddie Mac will extend several loan origination flexibilities until August 31 to ensure continued support for borrowers during the COVID-19 national emergency.

Hotel Sector Bouncing Back But Faces Continued Threats

CBRE, Los Angeles, said the hotel sector has seen 10 straight weeks of occupancy gains, but the recent COVID-19 diagnosis increase threatens to derail its progress.