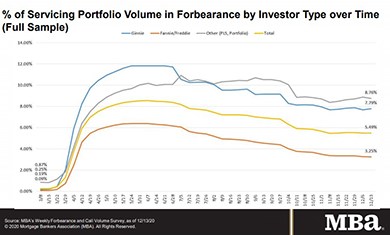

MBA: Share of Mortgages in Forbearance Ticks Up

The Mortgage Bankers Association’s latest Forbearance & Call Center Survey reported loans in forbearance increased slightly to 5.49% of servicers’ portfolio volume as of December 13 from 5.49% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

MBA, Trade Groups Ask Federal Agencies for Clarity on CARES Act Forbearance

The Mortgage Bankers Association, the American Bankers Association and the Housing Policy Council on Thursday asked federal agencies to issue guidance establishing a consistent timeframe for CARES Act forbearance under their respective programs.

FHFA Holds GSE Affordable Housing Goals Steady

The Federal Housing Finance Agency on Wednesday announced its 2021 affordable housing goals for Fannie Mae and Freddie Mac will remain the same as they were in 2020. It also seeks input about future housing goals rulemaking.

FHFA Issues Proposed Rulemaking for Enterprise Liquidity Requirements, Seeks Comments

The Federal Housing Finance Agency, Washington, D.C., on Thursday announced it would seek comments on a proposed rulemaking regarding Fannie Mae and Freddie Mac liquidity requirements.

FHFA: GSEs Complete 539,000 3Q Foreclosure Prevention Actions

The Federal Housing Finance Agency released its third quarter Foreclosure Prevention and Refinance Report, showing Fannie Mae and Freddie Mac completed 539,451 foreclosure prevention actions in quarter, bringing to 5.2 million the number of troubled homeowners who have been helped during conservatorships.

FHFA: GSE Non-Performing Loan Portfolios Down 70%

The Federal Housing Finance Agency’s latest report on sale of non-performing loans by Fannie Mae and Freddie Mac showed of loans one or more years delinquent held in the Enterprises’ portfolios decreased by 70 percent.