MBA Asks CFPB to Extend GSE ‘Patch’ Sunset

The Mortgage Bankers Association, in a comment letter yesterday to the Consumer Financial Protection Bureau, asked the Bureau to extend the temporary GSE Qualified Mortgage loan definition, also known as the GSE “Patch,” for an additional six months following the effective date for the revised general QM parameters.

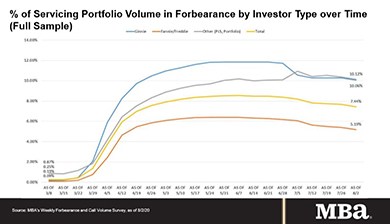

MBA: Share of Mortgage Loans in Forbearance Decreases for 8th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 23 basis points to 7.44% of mortgage servicers’ portfolio volume as of Aug. 2, down from 7.67% of servicers’ portfolio volume the prior week. MBA estimates 3.7 million homeowners are in forbearance plans.

MBA: Home Equity Lending Growth Hindered by Alternative Products and COVID-19

Home equity loan debt outstanding and borrower utilization rates declined in 2019 and mortgage lenders anticipate originations to fall again this year before increasing modestly in 2021, the Mortgage Bankers Association reported.

MBA, Trade Groups Ask Congress to Avoid Adding New Credit Reporting Provisions

The Mortgage Bankers Association and other industry trade associations asked Congress to refrain from adding new credit reporting provisions that may negatively affect consumers as Congress considers new COVID-19 response legislation.

MBA Shares Recommendations With CFPB Regarding LIBOR Transition

The Mortgage Bankers Association shared recommendations with the Consumer Financial Protection Bureau regarding the bureau’s proposed rule to amend Regulation Z to facilitate the transition away from LIBOR.