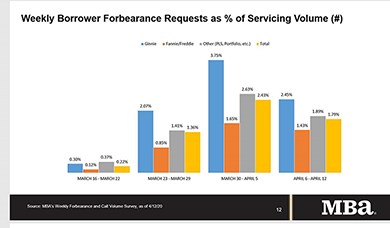

MBA Weekly Survey: Share of Mortgage Loans in Forbearance Rises to 5.95%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the total number of loans now in forbearance jumped from 3.74% of servicers’ portfolio volume in the prior week to 5.95% as of April 12.

MBA: 2019 IMB Production Volumes, Profits Rise

Independent mortgage banks and mortgage subsidiaries of chartered banks made an average profit of $1,470 on each loan they originated in 2019, up from $367 per loan in 2018, the Mortgage Bankers Association reported Friday in its Annual Mortgage Bankers Performance Report.

CFPB Issues Final Rule Raising HMDA Data Reporting Thresholds

The Consumer Financial Protection Bureau last week issued a final rule raising loan-volume coverage thresholds for financial institutions reporting data under the Home Mortgage Reporting Act.

ATTOM: March Foreclosure Report Reflects Calm Before the Storm

ATTOM Data Solutions, Irvine, Calif., released its quarterly U.S. Foreclosure Market Report, which showed 156,253 U.S. properties with a foreclosure filing during the first quarter, up 42 percent from the previous quarter but down 3 percent from a year ago.

OCC Issues Guidance on FEMA/Flood Insurance Force-Place Requirements

The Office of the Comptroller of the Currency on Wednesday provided guidance to the Mortgage Bankers Association, addressing conflicts between a recent Federal Emergency Management Agency memo and banking agency flood insurance rules.

Fannie Mae, Freddie Mac Extend URLA Implementation Timeline

Freddie Mac and Fannie Mae announced yesterday they will extend the implementation timeline for the redesigned Uniform Residential Loan Application and automated underwriting systems to support the industry during the COVID-19 pandemic.

Redfin: U.S. Housing Market ‘Reverses Course’

In little more than a month, the coronavirus pandemic sent the housing market from a promising spring to a national emergency, said Redfin, Seattle.