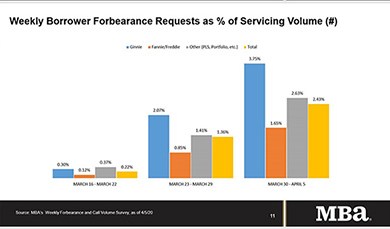

MBA Survey: Share of Mortgage Loans in Forbearance Continues to Climb

The surge in unemployment claims filed since mid-March resulting from the mitigation efforts to slow the spread of the coronavirus are straining household budgets and leading to more requests for mortgage forbearance. That is according to the Mortgage Bankers Association’s latest Forbearance and Call Volume Survey, which revealed the total number of loans in forbearance jumped from 2.73% to 3.74% during the week of March 30 to April 5.

Groundswell of Support Builds for Federal Liquidity Facility

Pete Mills, MBA Senior Vice President of Residential Policy and Member Engagement, said the groundswell is sending a strong message to regulators.

Ginnie Mae Implements Broad-Based Servicer Liquidity Facility

Late Friday, Ginnie Mae issued All Participants Memorandum 20-03 (APM 20-03), which expands its Issuer assistance programs to current circumstances stemming from the coronavirus pandemic. The APM introduces a new ...

Senators Up Pressure on Administration to Provide Liquidity Facility

A bipartisan group of senators joined the Mortgage Bankers Association in raising concerns with the Trump Administration to provide urgent action to avoid a critical strain on liquidity for certain home mortgage servicers.

CoreLogic: Annual Delinquency Rates Fall for 25th Consecutive Month

CoreLogic, Irvine, Calif., reported 3.5% of mortgages in some stage of delinquency in January, an 0.5 percentage point decline in the overall delinquency rate from a year ago.

Black Knight: COVID-19 Unemployment Spike Triggering Surge in Mortgage Forbearance Requests

Leading up to the coronavirus outbreak, said Black Knight, Jacksonville, Fla., the vast majority of mortgage performance metrics were at or near record levels. Now, says Black Knight Data & Analytics President Ben Graboske, the mortgage market has been turned upside down.

ATTOM: 2019 Property Taxes Rise to $306 Billion

ATTOM Data Solutions, Irvine, Calif., reported property taxes levied on more than 86 million single-family homes in 2019 totaled $306.4 billion, up 1 percent from $304.6 billion in 2018—the smallest increase in three years.