Yesterday, the Mortgage Bankers Association led a coalition letter sent to the Board of Governors of the Federal Reserve that conveyed the housing industry’s serious concerns about the negative market impacts the Fed’s monetary policy actions (e.g., rate hikes and quantitative tightening) are having on the market.

Category: News and Trends

Veros Projects 2.2% Home Value Appreciation

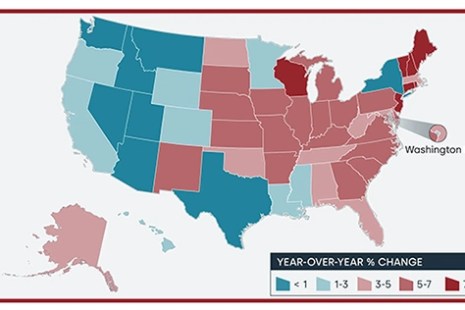

Veros Real Estate Solutions, Santa Ana, Calif., projects home values will appreciate 2.2% over the next 12 months.

CoreLogic: Annual Home Price Growth Picks Up Pace

U.S. home prices (including distressed sales) increased by 3.7% year-over-year in August, according to CoreLogic, Irvine, Calif.

September Jobs Report Exceeds Expectations

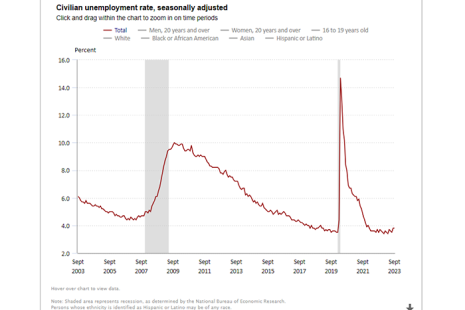

The job market remained quite strong in September, with nonfarm employment increasing by 336,000, the U.S. Bureau of Labor Statistics reported Friday.

Servicing Quote Tuesday, Oct. 10, 2023

“The speed of these rate increases, and the resulting dislocation in our industry, is painful and unprecedented, absent larger economic turmoil. We understand how severely this is straining your business and the extremely difficult decisions you must make to remain competitive.”

–MBA President and CEO Robert Broeksmit, CMB

Fannie Mae: Mortgage Lenders Cite Operational Efficiency as Primary AI Motivation

Mortgage lenders overwhelmingly cited improving operational efficiency as their primary motivation for adopting Artificial Intelligence/Machine Learning, reported Fannie Mae, Washington, D.C.

Fitch Ratings: Life Insurers Can Withstand Commercial Real Estate Deterioration

Fitch Ratings, New York, said U.S. life insurers’ ratings are not currently at risk from commercial real estate exposure, due to insurers’ stable investment portfolios, conservative underwriting, strong liquidity and effective asset-liability management.

Velocity Servicing President Matt Stadler Discusses Loan Stress

MBA NewsLink interviewed Velocity Servicing President Matt Stadler about loan stress. Stadler is responsible for all operations of Velocity Servicing, a specialty and component servicer focused on investors in credit-sensitive products (EBOs, NPL/RPL, and high-risk assets), dedicated to turning distressed loans into performing portfolios faster through high-touch customer relationships and advanced data analytics.

PCV Murcor Offering Property Data Collection

PCV Murcor Now Offering Fannie Mae Value Acceptance + Property Data Collection With Our Nationwide Coverage

Voting for 2024 MBA Officers, New & Returning Directors Underway; Deadline Oct. 12

The voting period for the election of the Mortgage Bankers Association’s FY2024 officers and new and returning directors is underway. The voting ends at 5:00 p.m. E.T. on Thursday, October 12, 2023.