ATTOM, Irvine, Calif., showed a jump in foreclosures in its Q3 U.S. Foreclosure Market Report. At 124,539 properties with foreclosure filings, they’re up 28% from Q2 and 34% from last year.

Category: News and Trends

Cenlar’s Lori Pinto, CMB: Delivering the Best Homeowner Experience

The U.S. economy and housing market has been anything but predictable the last few years.

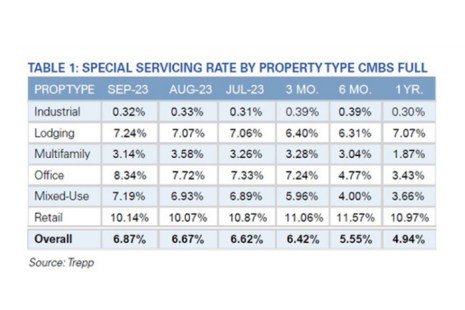

Trepp: Special Servicing Rate Climbs in September

Trepp, New York, reported the CMBS Special Servicing Rate increased by 20 basis points in September, up to 6.87%.

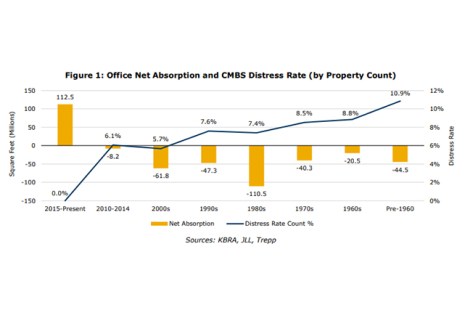

KBRA: Older Office Buildings Struggling

KBRA, New York, said in the current office environment, older buildings are seeing particular challenges.

PCV Murcor Offering Property Data Collection

PCV Murcor Now Offering Fannie Mae Value Acceptance + Property Data Collection With Our Nationwide Coverage

Servicing Quote Tuesday, Oct. 17, 2023

“The number of loans in forbearance dropped in September, but the overall performance of servicing portfolios and loan workouts declined slightly.”

–Marina Walsh, CMB, MBA Vice President of Industry Analysis.

MBA, Housing Trades Call on Fed to End Rate Hikes, Pledge Not to Sell MBS Book

Yesterday, the Mortgage Bankers Association led a coalition letter sent to the Board of Governors of the Federal Reserve that conveyed the housing industry’s serious concerns about the negative market impacts the Fed’s monetary policy actions (e.g., rate hikes and quantitative tightening) are having on the market.

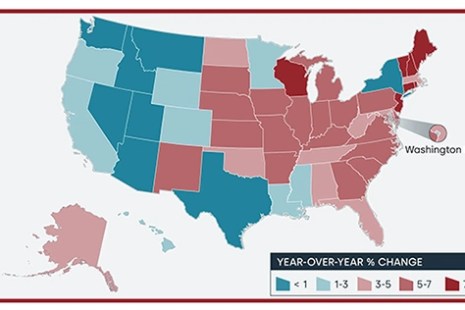

Veros Projects 2.2% Home Value Appreciation

Veros Real Estate Solutions, Santa Ana, Calif., projects home values will appreciate 2.2% over the next 12 months.

CoreLogic: Annual Home Price Growth Picks Up Pace

U.S. home prices (including distressed sales) increased by 3.7% year-over-year in August, according to CoreLogic, Irvine, Calif.

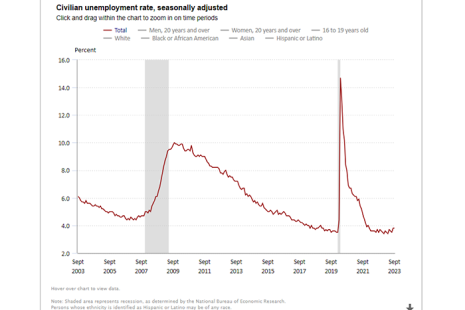

September Jobs Report Exceeds Expectations

The job market remained quite strong in September, with nonfarm employment increasing by 336,000, the U.S. Bureau of Labor Statistics reported Friday.