Industry members who achieve the Mortgage Bankers Association’s Commercial Certified Mortgage Servicing designation will now have a newly rebranded home for networking and collaboration–the CCMS Designee Society.

Category: News and Trends

MBA: Commercial and Multifamily Mortgage Debt Outstanding Increased by $37 Billion in Third Quarter

The level of commercial/multifamily mortgage debt outstanding increased by $37.1 billion (0.8%) in the third quarter of 2023, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report.

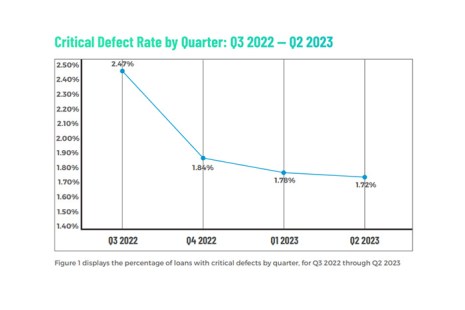

ACES: Critical Defect Rate Falls for Third Straight Quarter

ACES Quality Management, Denver, Colo., reported the critical defect rate for the second quarter of 2023 fell to 1.72%, a 3.37% decrease and the third consecutive quarter of declines.

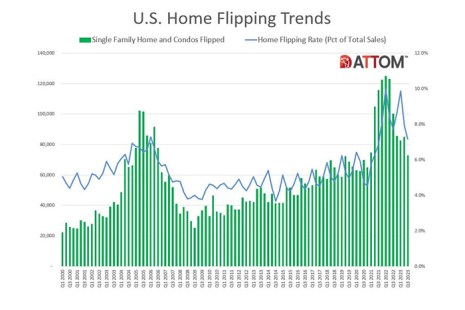

Home Flipping Declines Again, ATTOM Finds

ATTOM, Irvine, Calif., found the rate of house flipping–while still historically high–has fallen to the lowest point in two years.

Servicing Quote Tuesday, Dec. 19, 2023

“Nearly 96% of all home mortgages are performing, which underscores how strong servicing portfolio performance is right now with the same resilience seen in the U.S. labor market.”

–Marina Walsh, CMB, MBA’s Vice President of Industry Analysis

Craftsman: Homeowners Eye Home Improvement Projects Over Selling

Craftsman, part of Stanley Black & Decker, Towson, Md., released a survey finding that two in three American homeowners intend to make home improvements in the next six to 12 months.

Milliman: Mortgage Default Risk at 3.1% for Loans Acquired in Q3 2023

Milliman, Seattle, released its third-quarter Milliman Mortgage Default Index, which showed that quarter-over-quarter, mortgage default risk increased to 3.1% for loans acquired during the quarter from an adjusted 3.03% in the second quarter.

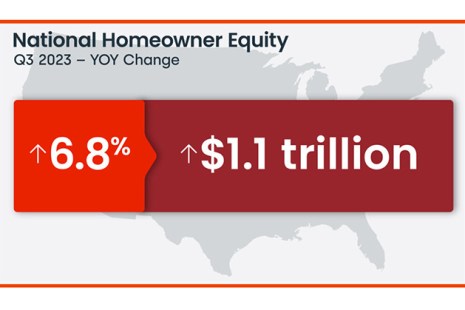

CoreLogic: Homeowner Equity Up 6.8%

CoreLogic, Irvine, Calif., found U.S. homeowners with mortgages’ equity has increased by $1.1 trillion since this time last year, a 6.8% gain year-over-year.

ATTOM: California, New Jersey, Illinois Have Highest Concentrations of At-Risk Markets

California, New Jersey and Illinois have the highest concentrations of the most-at-risk markets in the country, according to ATTOM, Irvine, Calif.

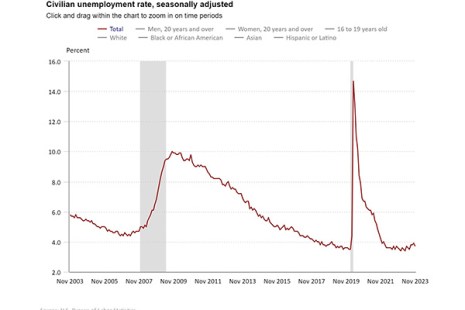

Jobs Increase in November, Unemployment Rate at 3.7%

Total nonfarm payroll employment increased by 199,000 in November, and the unemployment rate now sits at 3.7%, the U.S. Bureau of Labor Statistics reported.